Interesting technical constellation for the S&P 500 index. Today’s intra-day low (1,258.07) almost touched the 200-day moving average (1,257.90). The exponential 200-day moving average (1,262.85) was breached (but not on a closing basis). Tomorrow, Friday June 17th, is a big option expiration day, so anything is possible. However, the 200-day moving average will not fall easily and I would expect some “fighting” over it. Also, the March lows (1,250) should provide some short-term support.

Market breadth as measured by the Nasdaq Advance-Decline line does not suggest an end to the down trend:

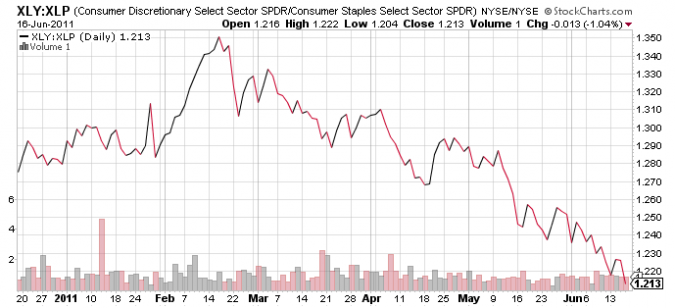

Cyclical sectors (i.e. consumer discretionary stocks, XLY) continue to underperform defensive sectors (i.e. consumer staples, XLP):

Volatility has risen markedly, and could rise even more:

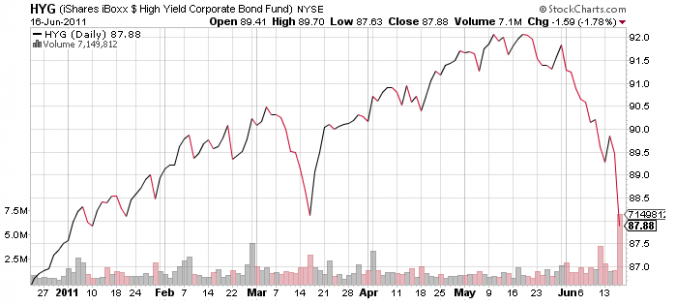

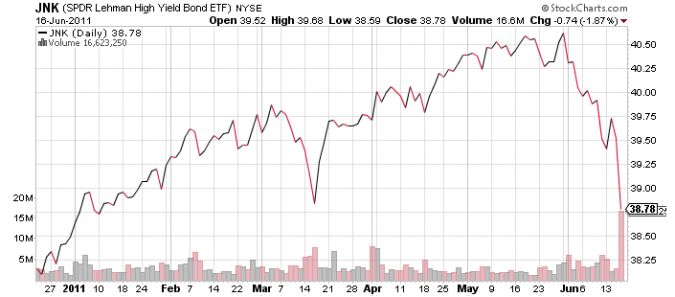

Worth mentioning the dramatic sell-off in high yield (HYG) and junk-rated (JNK) corporate bonds today – look at the volume:

Since end of May yields have gone up to 7.91% (7.71%) for high-yield and to 8.46% (8.29%) for junk-rated bonds. Yields of long-term treasury bonds, on the other hand, have declined to 4.21% (from 4.24%).

Finally, the internet bubble 2.0 seems to have popped; recent IPO’s Linked-In (LNKD), RenRen (RENN) or Pandora (P) have had spectacular declines:

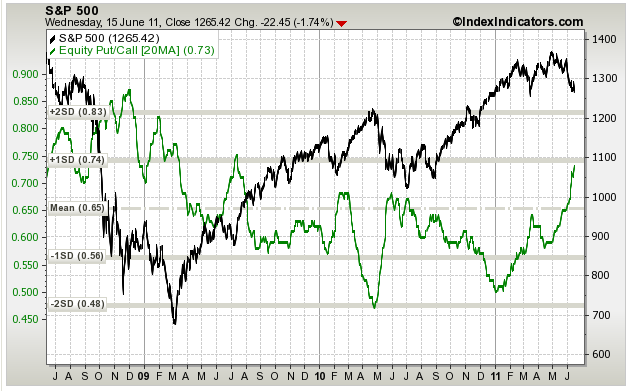

Some market commentators point towards the bearish sentiment among investors as a sign of an approaching bottom; it should be pointed out that sentiment was terrible before the Lehman bankruptcy – and the worst was still to come:

Future news-flow could remain negative with Greece quickly deteriorating and further economic weakness in the US.