At the suggestion of one of our clients we looked at the momentum of S&P 500 sub-sectors.

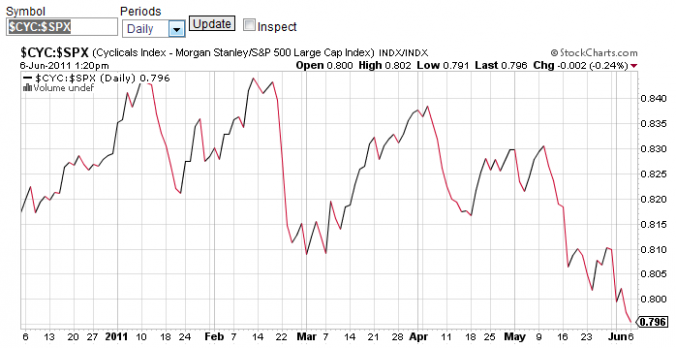

This might give a better picture of the overall stock market health. For example, the May 31st high hid the fact that cyclical stocks were already in decline since February on a relative basis:

Now, look at Healthcare stocks in comparison:

This is a phenomenon you often see when bull markets roll over: portfolio managers “have” to be invested (by-laws of the fund often do not permit more than 5% cash ratios). But they are afraid of a slow-down in the economy. So they shift (as much as permitted by their style box) into more defensive names. Overall cash invested in the stock market does not change – but the internal composition changes. This leads to cyclical stocks becoming “cheap” and defensive ones “expensive”. This has the unfortunate effect that, when the economy craters, even defensive names lose quite a bit (i.e. Nestle from CHF 400 to 237 in 2001-2003), offering really no place to hide.

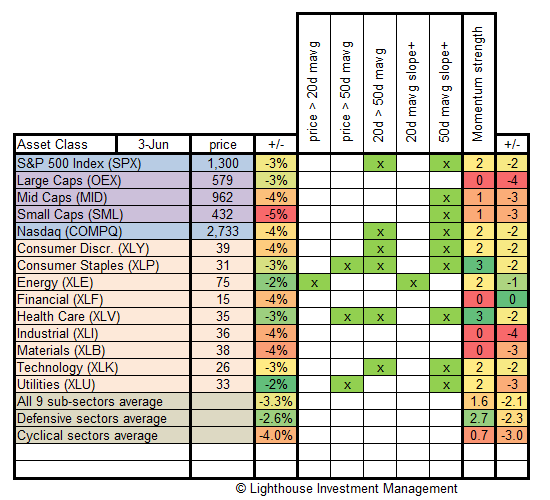

To get a better idea of where the market momentum is we applied our asset class momentum analysis to 9 S&P 500 sub-sectors as well as some other market indices:

- Momentum has slowed terribly in all major indices (especially large caps and cyclical stocks).

- Performance-wise, defensive stocks outperformed (as expected). Small caps took the biggest hit (also to be expected).

- Defensive sectors (Consumer Staples, Health Care, Utilities) have an average momentum rating of 2.7 (second last column).

- Cyclical sectors (Consumer Discretionary, Industrial, Materials) show an average momentum rating of only 0.7.

- The Energy, Financial and Technology sector are somehow different animals (reacting to oil price or mortgage lawsuits, while Apple is rather a consumer stock). We have not included them in neither “defensives” or “cyclicals”.

- The idea is to chart the average momentum rating of defensives and cyclicals over time and to detect a correlation with overall market (and / or sector) performance.

Conclusion:

Based on current sector momentum ratings investors should be overweight Healthcare and Consumer Staples, but underweight Financials, Industrials and Materials.