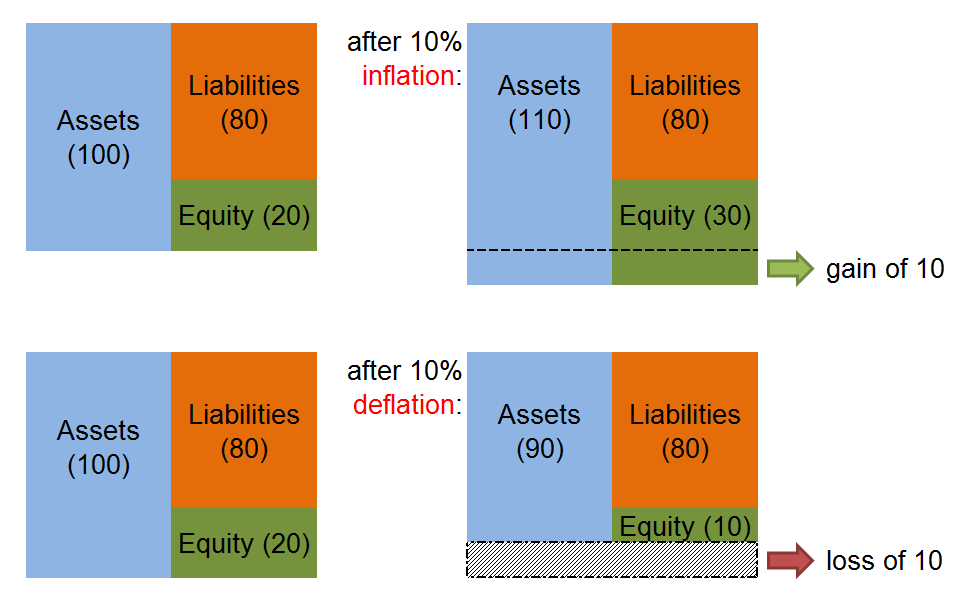

Economics class is in session! Let’s have a look on the impact of inflation and deflation on companies. We are focusing on the balance sheet only:

Impact of inflation and deflation on balance sheets. Source: Lighthouse Investment Management

Impact of inflation and deflation on balance sheets. Source: Lighthouse Investment Management

Inflation means prices go up, so the value of the asset side of the balance sheet increases. Liabilities remain the same (you took a bank loan for $100m a year ago. You pay back same $100m, but now, thanks to inflation, those $100m are worth less. You can buy less stuff with the same amount of money, since the price of everything went up). Equity goes up, and profitability is increased accordingly (ceterus paribus). The stock price should go up.

In a deflation scenario, prices of assets decline, while liabilities remain same (you took a $100m bank loan, and you have to pay back $100m. But now, the $100m are worth more than when you borrowed it because it buys more “stuff” than a year ago as prices declined). This reduces equity, and company makes a loss. In extreme cases, the entire equity could be eaten away and the company goes bankrupt. The effect on the stock price should be obvious.

Now think about a bank. Let’s take… Citibank!

Assets (6/30/2010): $1,938bn (that’s almost 2 trillion)

Liabilities: $1,783bn

Equity: $155bn (8% of assets).

Some say that $25bn goodwill and $50bn of tax-deferred assets should have been written down. This would reduce equity to $80bn or 4% of assets. Now you see how even a mild deflation would wipe out many banks. Now you understand why the Fed is fighting deflation tooth and nail.

It’s that simple: inflation = good for stocks, bad for bonds. Deflation = bad for stocks, good for bonds (as long as the borrower can pay them back at maturity).

So the “$64m question” is if the Fed will be successful in avoiding deflation. That’s for another post.

One response to “Why the Fed is fighting deflation tooth and nail”

[…] and foremost the banks). The Fed will try to fight deflation (as we pointed out in this post: http://www.lighthouseinvestmentmanagement.com/2010/10/26/why-the-fed-is-fighting-deflation-tooth-and…). It seems the Fed is losing the […]