There is one simple rule for investors: avoid all things beginning with “Euro-“. Eurotunnel ended in bankruptcy. Eurodisney was a disaster for public shareholders. And so the Euro itself is following the same path.

European politicians are faced with one problem: none of their plans to end Europe’s debt crisis has worked. Absolutely nothing. Which is not that surprising – since when does adding debt solve a debt problem?

Fishing in Lake Acronym yielded only meager catches like SGP (“Stability and Growth Programme”, a paradox), SMP (“Securities Market Programme”, which has less to do with market than with manipulation), and, finally, the bazooka: the EFSF (European Financial Stability Facility).

“Stability” sounds good, and “Facility” leaves the uninitiated in the dark as to whether this is another debt pyramid and who will ultimately foot the bill.

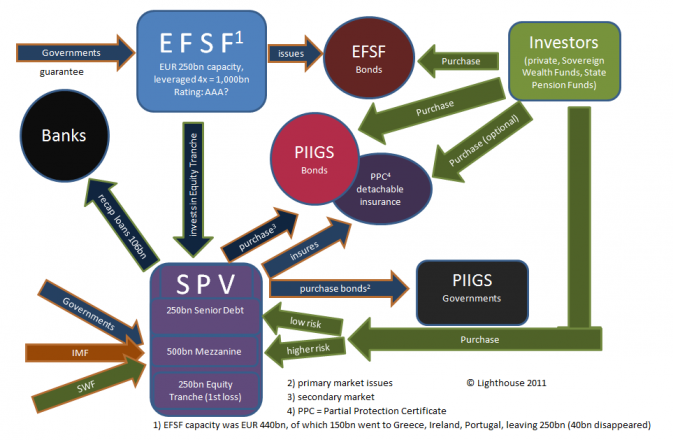

The idea behind the EFSF must be so good the agency wants to keep it to itself and prefers not to shed light on the mechanism behind it. Based on leaked drafts and comments in the press it could look like this:

Observations:

- Since Germany successfully repelled French demands for an EFSF banking license creative minds found ways of leveraging the (non-existent) funds.

- The original EFSF capacity was EUR 440bn; 150bn already went to Greece, Ireland and Portugal. After 40bn inexplicably vanished, 250bn are left.

- EUR 250bn is nothing compared to the funding requirements of Italy and Spain; hence it needs to be “leveraged”.

- The EFSF would invest those 250bn in the “equity” (or high risk) tranche of a “Special Purpose Vehicle”. Governments, the IMF and Sovereign Wealth Funds (SWF) are supposed to gobble up the 500bn “mezzanine” (or medium risk) tranche. Together with a 250bn “low risk” tranche the SPV would have EUR 1 trillion in firepower.

- This firepower is then used for purchasing “PIIGS” government bonds in primary and secondary markets. Some small change (EUR 106bn) would even be left over to recapitalize the entire European banking system.

- To entice investors formerly burnt in PIIGS bonds to repeat their mistake, the SPV would issue “partial protection certificates” (PPC). Those PPC’s are in fact credit default swaps, but since politicians have blamed the latter for the consequences of their own actions they had to come up with a different name.

- Credit default swaps (unless the gods at ISDA decide otherwise) at least pay out the difference between par (100%) and the recovery value. PPC’s would cover only a limited amount (20%, for example). Because, you know, a sovereign default wouldn’t be that bad. Greece, of course, is unique and an exception. Right; so unique that RBS wrote down its Greek holdings to 37 cents on the Euro.

- For the “unlikely” event of a default (a 1 in 3 chance for Italy and Spain over the next five years according to implied default probabilities) the PPC will pay out a small token (in appreciation of your stupidity) of consolation. Not in cash, however, but in EFSF bonds. This is usually referred to as “captive insurance”. It is akin to the agent selling life insurance policies on the already listing Titanic.

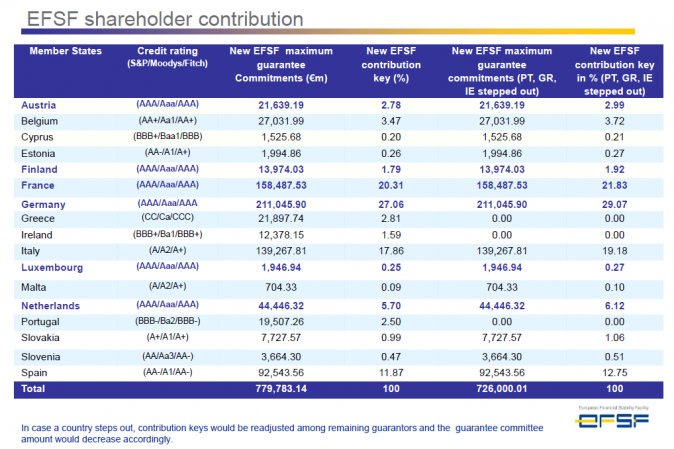

- Not only is the insurance circular, but so are the guarantees. Keep in mind that all the EFSF has raised to far is EUR 14bn (and that money is already spoken for). Initial “guarantees” of EUr 780bn have melted down to 726bn as Greece, Ireland and Portugal have “stepped out” (they can’t participate in their own rescue). In case of “step-outs”, the maximum guarantee is reduced and remaining countries have their share of guarantees increased. It’s a game of inverse musical chairs where the last one standing loses, not wins.

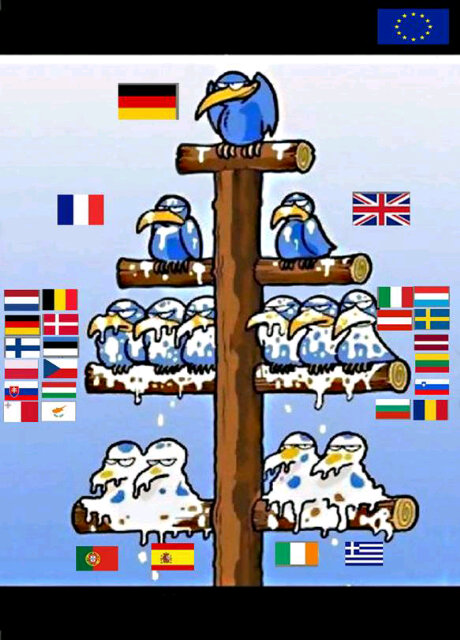

- The only AAA-rated countries left are Germany, France, the Netherlands, Austria, Finland and Luxembourg. The last three do not matter due to size. With the German-French 10-year government bond spread at 1.5% the market believes France is about to lose its AAA. That leaves Germany and the Netherlands, or 33% of the original guarantors. In case Italy and Spain need money, 30% of the guarantors would “step out”, at which point the self-insurance scheme collapses:

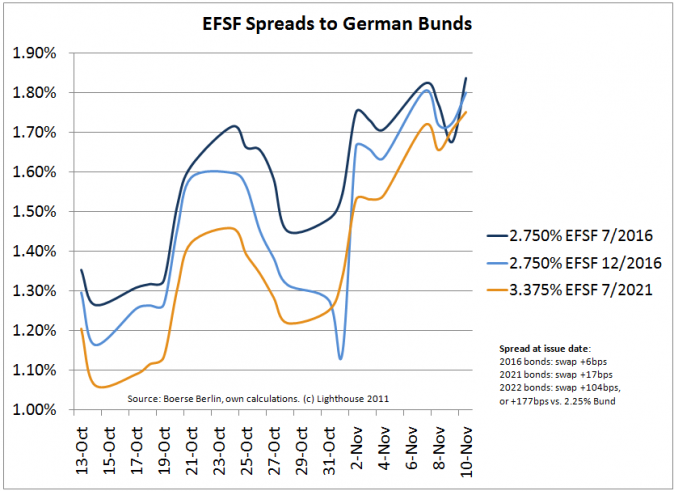

- Condolences go out to the poor souls who bought the first three issues of EFSF debt at minuscule spreads to swap rates. Official lenders like the IMF (and, until the “comprehensive plan to save the Euro-zone”, the EFSF) are not supposed to take haircuts as this could cause abdominal pains with innocent taxpayers in other regions of the world. Hence the “AAA” rating for the EFSF. But during the night of October 26/27, the beautiful EFSF butterfly went into reverse metamorphosis and emerged as an ugly larvae. “Last loss” became “first loss” participation. The risk profile had been changed by the stroke of genius. And it showed in the yield spreads to German government bonds:

- It therefore does not come as a surprise the EFSF had to first scale down, then postpone, then buy part of their own bonds during the recently failed auction. According to an investor presentation in August, the plan was to have 7 bond issues by the end of 2011 (3 for Ireland, 4 for Portugal). It looks like the recent (4th) might have been the final one.

- In a desperate move, Klaus Regling (CEO of EFSF) announced plans to raise money via short-term bills with maturities of less than a year instead. Lend long, borrow short – even bankers understand this is a recipe for disaster.

- There was an odd statement by Chancellor Merkel at the recent G20 meeting in Cannes: “Hardly any countries in the G20 have said to participate in the EFSF”. This struck me as odd, since it was the truth, and politicians are not known to tell the truth. Did Merkel suffer from the effects of an extended stay at the bar with Putin? Unlikely. This just does not fit the usual “we will do everything to save the Euro”-line. She could have said something like “I am convinced the EFSF bond issue will be fully subscribed; the demand is so high we decided keep the books open for a little bit longer”. But no, she chose to tell the truth. Maybe it had dawned on her that the EFSF was actually a formula for mass (financial) suicide and that Germany would be the one footing the bill in the end? The only way to “escape” being burdened with other countries’ debt is to “step out” of the circle of guarantors. This could actually hasten the financial crisis.

2 responses to “The Euro Fiasco Suicide Formula (EFSF)”

[…] hopes of progress in Europe | Reuters Australian shares jump 1.5% in early trading – MarketWatch The Euro Fiasco Suicide Formula (EFSF) | Lighthouse Investment Management Unemployment to continue rising in Q4 – CIPD poll | Reuters Nitey nitey rollercoaster dweebs […]

[…] http://www.lighthouseinvestmentmanagement.com/2011/11/13/the-euro-fiasco-suicide-formula-efsf/ […]