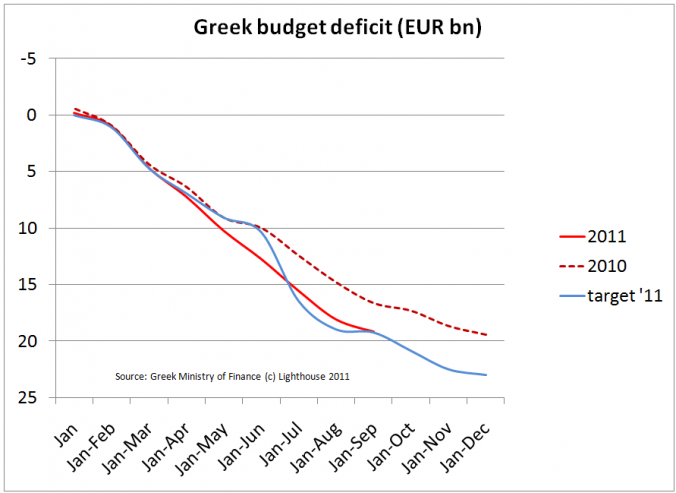

- The Greek January – September budget deficit was EUR 19.16bn versus 16.65bn same period last year (+15%). This only includes the central government.

- The initial deficit target for 2011 was EUR 17bn. We blew past that after only 8 months. The revised target (July) is now 22bn (9.5% of GDP).

- Latest estimate from the Greek government: 8.5% deficit (19.5bn) for 2011 (instead of 7.6% or 17bn).

- Here’s a chart of the budget deficit (cumulative):

- You can see that 2011 pans out to be worse than 2010 (dashed line).

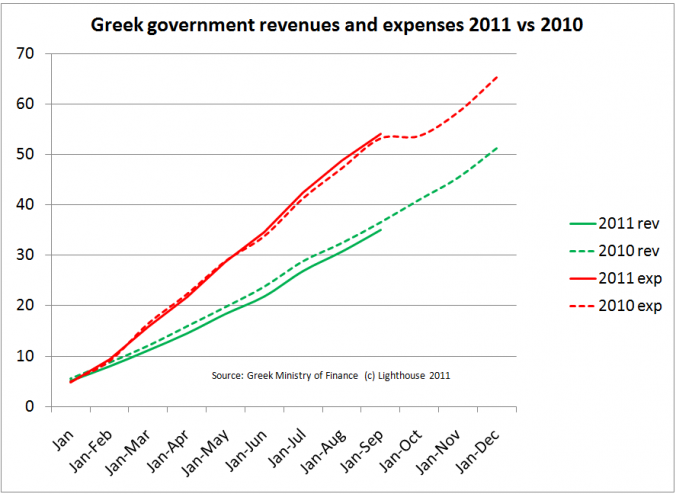

- Revenues are negatively impacted by the severe recession. Okay, but what about expenses?

- While 2011 revenues are trending below 2010, expenses are trending higher.

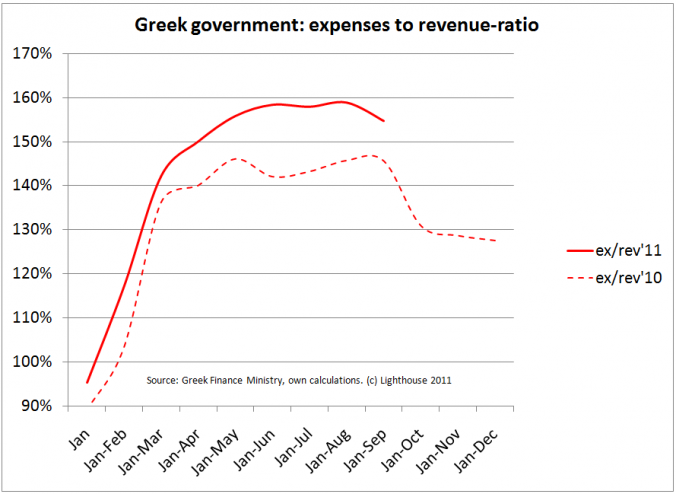

- Despite all the austerity measures, Greece is still spending 150% of its revenues:

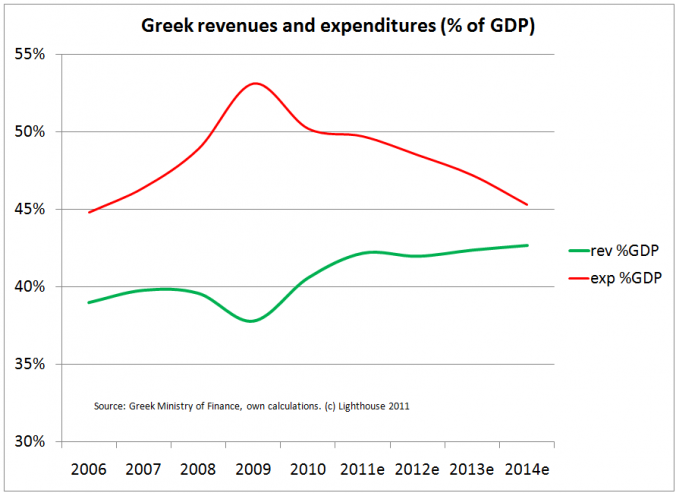

- Of course, the Ministry of Finance sees a reduction of the deficit to a miniscule 2.6% of GDP by 2014 as revenues rise and expenses come down:

- How is that possible? Somehow, after spending four consecutive years in recession (2009-2012), the economy will rise like a phoenix and grow by 5.8% in 2014.

- I leave it up to you to decide if this is credible.

- One more thing: interest expenses were 14bn after 9 months = 18.7bn annualized.

- As of June 30, Greek government debt stood at EUR 353.7bn.

- You do the math – Greece is paying an average interest rate on its debt of 5.28% (less than Italian 10-year bond yield).

- If Greece were to pay market rates (let’s be generous and take 10-year yields of 24%), it would spend EUR 84bn on interest.

- This would exceed government revenues.

One response to “The Greek (Ministry) Mystery of Finance”

[…] October 12, 2011 The Greek (Ministry) Mystery of Finance | Lighthouse Investment Management: http://www.lighthouseinvestmentmanagement.com/2011/10/12/the-greek-ministry-mystery-of-finance/ […]