BoJ (Bank of Japan) Governor Kuroda shook up FX markets a bit overnight, suggesting the Yen was unlikely to weaken further:

The Yen rose quickly versus the Dollar from 124.50 to 122.50 (less Yen needed to buy one Dollar = stronger Yen):

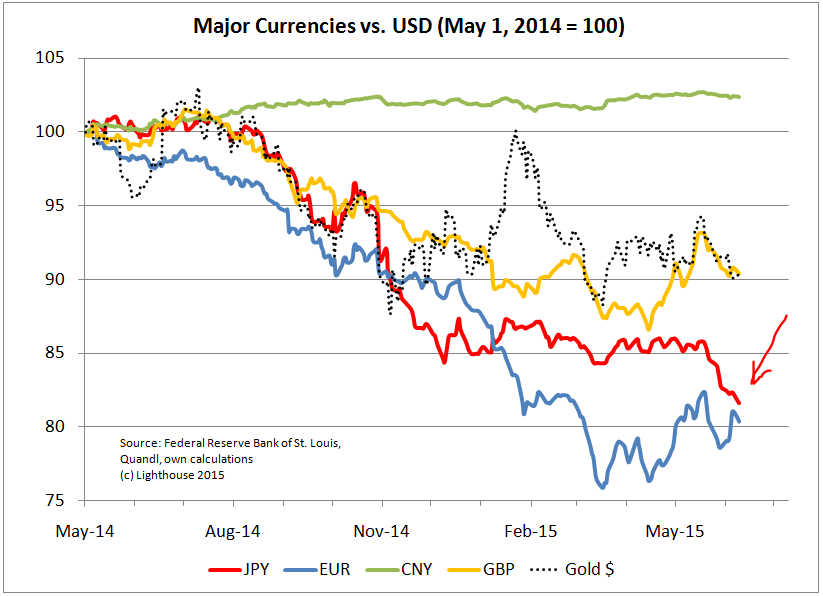

This is puzzling. The Yen had just begun another leg down after remaining in a sideways pattern since late 2014:

Is the Yen getting too weak for the Japanese’s taste? Hard to imagine. They want inflation. A weak Yen leads to imported inflation, especially since Japanese oil imports have soared after Fukushima idled many Japanese nuclear power plants.

The other story is the continued rise of German government bond yields (10-year from 0.05% to 1.00%). It seems to be correlated to the EUR / USD rate:

(h/t Volker Zschaepitz aka @Schuldensuehner)

But which one is the egg, which one the chicken?

Meanwhile the Euro reached 1.1385 versus the Dollar. A strong(er) Euro is dampening attractiveness of export goods from Europe to Dollar-thinkers (includes China). Hence the German DAX Index underperforms when the Euro strengthens.