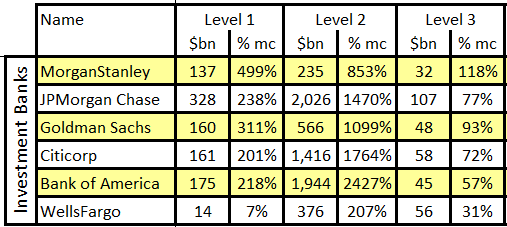

I went through the latest available 10-Q filings of major US investment banks. I was after the break-down of assets in levels 1-3. As a reminder:

- Level 1: stuff that has a market price.

- Level 2: stuff that doesn’t have a market price, but is valued based on similar assets.

- Level 3: stuff that where there is no market price, and management values it according to a model (“mark-to-model”, a.k.a. “mark-to-myth” or “mark-to-make-believe”).

If you invest in companies with 50-100% of market capitalization (mc) invested in opaque and possibly illiquid assets then only God may help you:

Take into account that FAS (Federal Accounting Standard) 157 was amended in April 2009 due to “slight” political pressure (they threatened to take away the authority to set accounting standards from the FASB unless it complied) and you have a complete black box. No wonder few banks trade above their (meaningless) book value. P/E? Why would I pay a multiple for something that is more than 10x leveraged, however still cannot get a decent return on equity? How would the un-leveraged ROE look like? Low single-digits?