Traveling through Vietnam provided a few valuable lessons for life. You arrive, armed only with a copy of the Lonely Planet. Any map turns out to be pretty useless, as street names are frequently changed or the street layout completely altered (this is mid-1990’s). You are being inundated with offers from “cyclo-” (bicycle rickshaw) drivers. Rule number one: negotiate the fare before hopping on the seat. The Vietnamese being excellent sales people expect further price negotiations while you are riding (“Okay, price was per person” “Sir, luggage is extra”).

“Cyclo-” rickshaw in Hanoi, Vietnam

“Cyclo-” rickshaw in Hanoi, Vietnam

One particular cyclo driver left me with a memorable experience. Once given his destination he claimed the hotel was closed (“I know much better hotel”). Over the entire ride he insisted my hotel was said to be either under construction, on fire or simply full. And I insisted, too, so we actually ended up at the hotel. The pure existence of the hotel should have refuted most of his statements, but did not lead to any signs of embarrassment or repentance on his part. To my surprise he followed me into my room, still trying to lure me into changing hotels (“This room not good”). Later, I found him haggling with the hotel owner over a “finder’s fee” (which was customary for cyclo drivers bringing in hotel guests).

Lessons learned: (A) When you are standing inside a hotel it does exist, no matter what someone else might say. Accordingly, when a country is burdened with a debt level approaching 160% of GDP it does need a restructuring.

(B) The more often someone with (supposedly) local knowledge repeats an untruth, the easier it is to identify the lie. The more EU and ECB officials insist that a Greek debt restructuring is “not on the table”, “unthinkable” or “would have dire consequences”, the more likely it is to happen.

Sure, the consequences are dire, since the Greek banking sector and government have assured each other’s mutual destruction. If the government goes down, Greek banks owning government bonds also bite the dust. As FT’s Alphaville kindly pointed out[1], Alpha Bank owns EUR 4.6bn government securities compared to EUR 5.3bn of equity.

If the banks go down, the government will join them as there are no more purchases of government bonds (and subsequent regurgitation at the ECB sewage station).

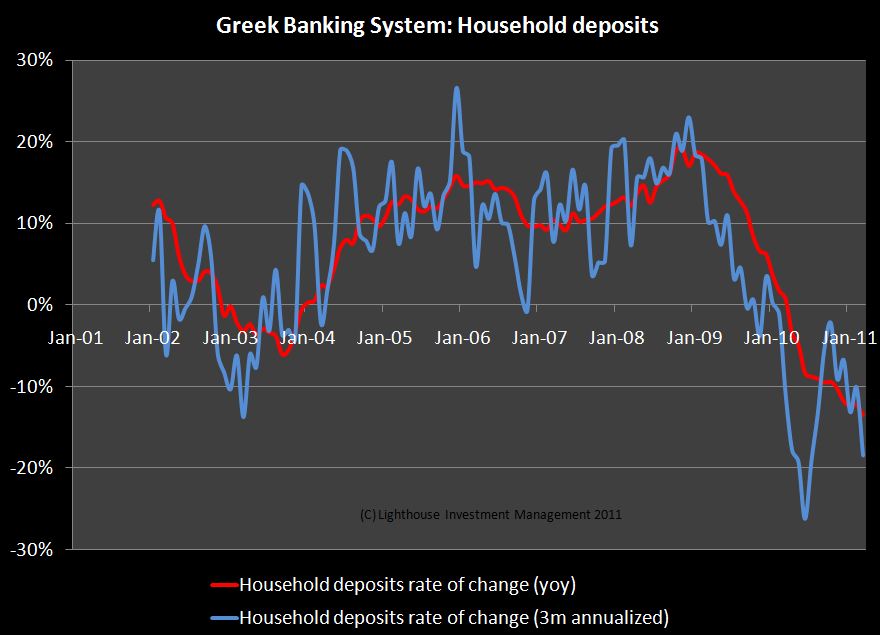

The banks go down if depositors flee, as there is no other funding option available. Unfortunately this seems to be exactly the case as reported by German newspaper FAZ[2] (my translation):

Fearing a government bankruptcy Greek savers are pulling deposits from local banks. According to the Bank of Greece household deposits have declined by more than EUR 31bn to 165.5bn. A portion of the money is apparently brought to other countries; customs officers have repeatedly caught people with large amounts of cash in their luggage. Speaking on national television on Tuesday, Giannis Gortsos, Secretary General of the Federation of Greek banks, assured savers their deposits were safe.

An analysis of data from the Bank of Greece (h/t Tyler Durden) indeed reveals an accelerating outflow of deposits:

Household deposits are currently falling by 14% compared to a year earlier, or 18% if annualized over the last three months. The data is from March, and is likely to have significantly worsened since then.

Household deposits are currently falling by 14% compared to a year earlier, or 18% if annualized over the last three months. The data is from March, and is likely to have significantly worsened since then.

A year ago, German, French and UK banks were caught with too much exposure to Greece. After pushing most of the debt on to taxpayers, Deutsche Bank CEO Ackermann[3] finally seems to have given the “green light” to cut Greece free from their debt harness:

If only there was a way to justify cutting the lifeline after a daily barrage of denials. And who is to blame? The EU? The IMF? A volcano?

Thankfully there is JC Juncker, president of the Eurogroup. He elegantly tees up the excuse “the IMF may not release tranche for Greece next month” as the IMF needed a 12-months financing guarantee and EU governments were unable to make up for the IMF portion.[4]

In case there was any doubt regarding Greece doing it’s homework (not!) he added that “Greece won’t reach its 2011 budget deficit goal”.

There you have it. You (Greece) don’t do your part – we (EU) don’t do ours.

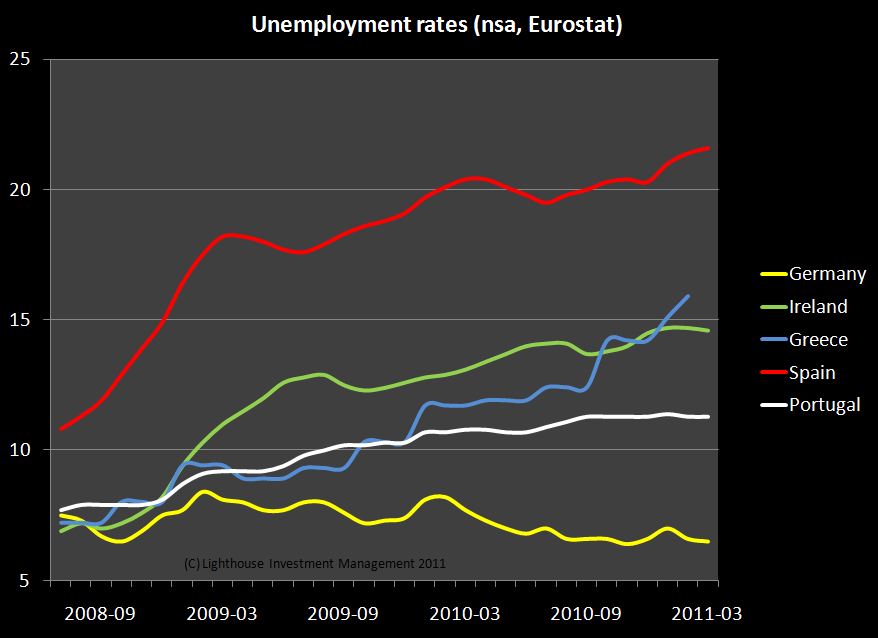

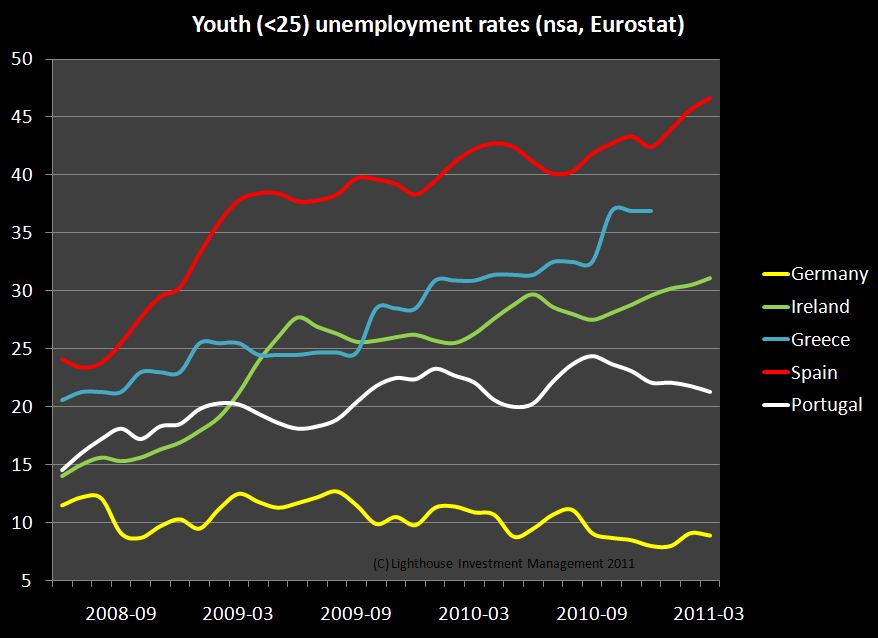

The rhetorical pathway for the EU out of their web of denials is being crafted. It’s about time. The Greek population is suffering. Unemployment is exploding. With youth unemployment reaching almost 50% in Spain it is only a question of time until the powder keg of discontent boils over.

The Euro has reached its final destination. It is time to quit repeating the same nonsensical denials on a daily basis. The passengers (readers of this blog) are seeing through the thinly veiled lies of their drivers (politicians) since a long time.

Alexander Gloy is founder and CIO of Lighthouse Investment Management

[1] Joseph Cotterill: A journey around Alpha Bank’s ECB collateral, in: FT Alphaville, May 24, 2011