US house prices have entered into an accelerating decline. The more I dig into the details the worse it gets.

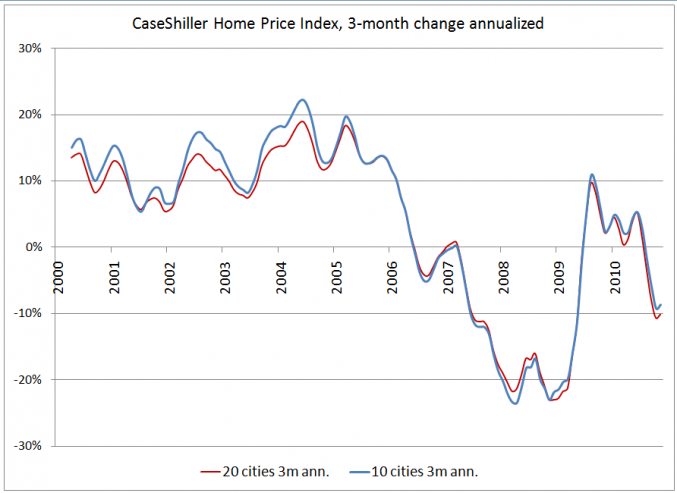

The most widely followed measure of US single family home price is the S&P Cash-Shiller Home Price Index (CS HPI). First a word on how it is calculated:

“The S&P/Case-Shiller Home Price Indices are calculated monthly using a three-month moving average and published with a two month lag. New index levels are released at 9 am on the last Tuesday of every month.”[1]

That means that the numbers released on January 25, 2011, is the November (2010) data (which is a mix of September, October and November). We are talking about data up to four months old. Still, we can get a better picture of what is going on by annualizing the 3-month rate of change:

Both the 10- and 20-city index are declining with 10% annualized rates. Source: own calculations

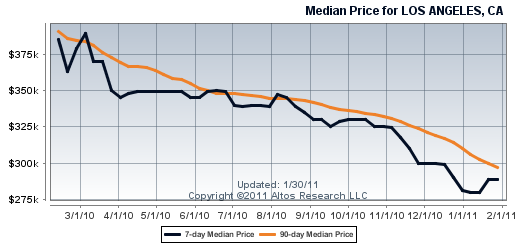

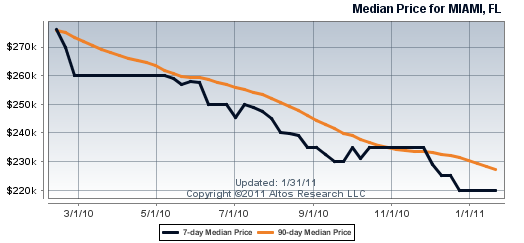

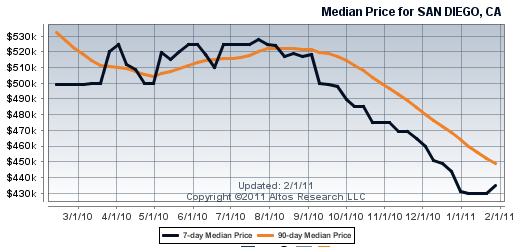

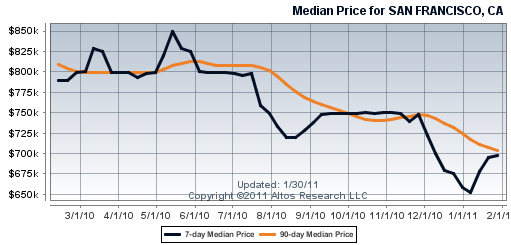

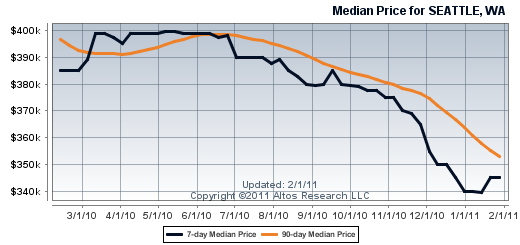

Working with 4-months old data is not very satisfying, but thankfully there is ALTOS Research, claiming to have real-time real estate data based on 15,000 zip codes. Their ALTOS-10-city index (closely correlated with the 10-city CS HPI index) declined 1.65% in December. This translates into a 12% year-over-year rate of decline.

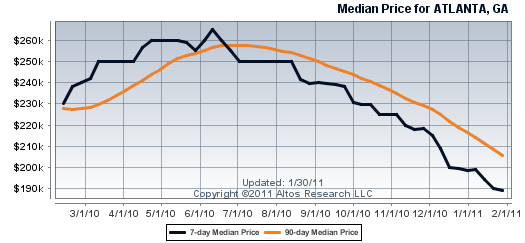

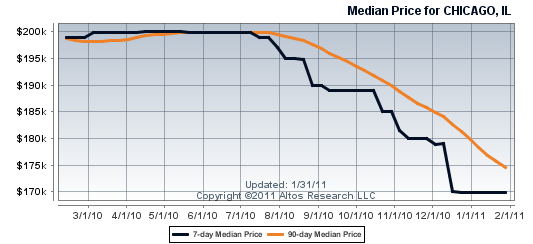

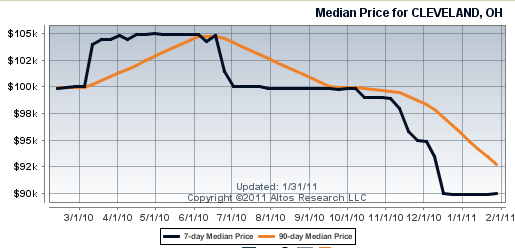

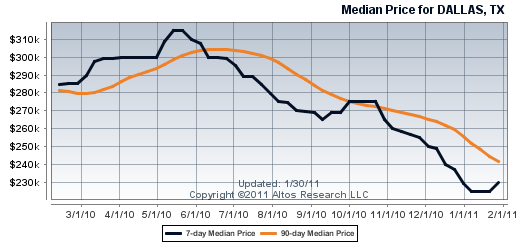

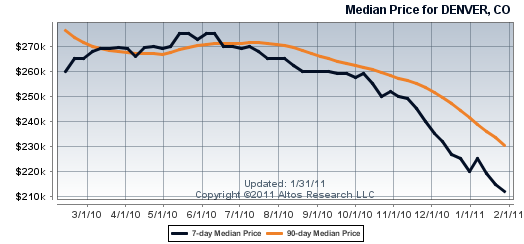

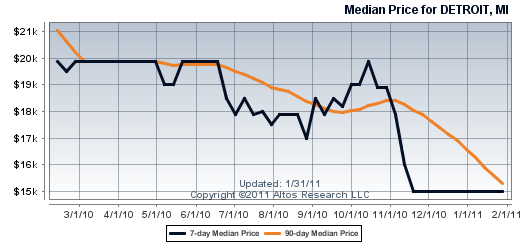

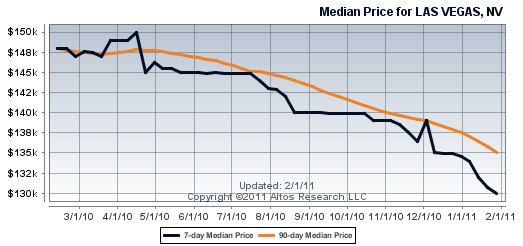

Seven (Phoenix, Miami, Tampa, Atlanta, Chicago, Detroit and Las Vegas) out of the 20 regional indices reached new lows in November 2010 – worse than in the worst days after Lehman Brothers. Let me show you a few metropolitan areas[2]:

Some of the declines in the last few months are truly staggering (Atlanta -27%, Dallas -26%, Detroit -25%). Sure, there is a seasonal effect (lack of buyers after back-to-school), but still… holy smokes. Wait for this data to show up in the Case-Shiller HPI.

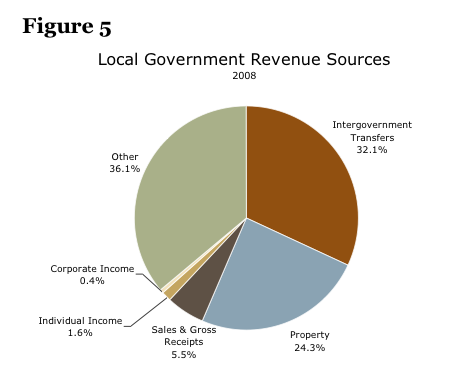

The median home price in Detroit is now $15,000. The land is basically worthless. There are plenty of homes on EBay for less than $5,000. Maybe the buyer will have to get paid to take possession of a property (in case there are unpaid property taxes etc). Why do banks let homeowners stay in their homes even two years after they defaulted on their mortgage? Because the banks do not want to pay property taxes either (or, as in some states, pay a landscaper to regularly cut the grass). What does that mean for local property tax revenues? I forgot where I found this chart; one quarter of local government revenue stemming from property taxes. Muni bonds anyone?

[1] Source: Standardandpoors.com website

[2] Source: www.altosresearch.com on January 31, 2011