10 year Portuguese government bond yields today retreated to 6.13% (from 6.31%) after the auction of fresh government debt: EUR 450m of 4yr paper at 4.70% (vs 3.62% at previous auction) and 300m of 10yr debt at 6.24% (vs 5.31%). The total of EUR 750m raised was at the low end of the planned 750m-1bn range. Welcome Portugal to the club (of countries where it would be cheaper to tap the EFSF – European Financial Stability Fund – than sell bonds in the market).

Meanwhile, CDS (credit default swap) rates for Ireland rose to 466bps (+26) and Portugal to 392bps (+20) in a sign that investors immediately bought insurance for those bonds recently issued.

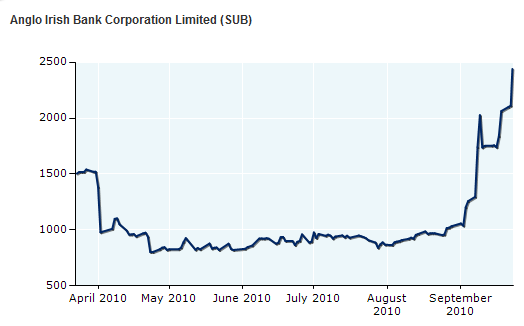

The CDS on subordinated bonds of Anglo-Irish Bank rose to a record 2,440bps (+330) after a statement by the Irish Debt Agency that “no assurances have been given to Anglo-Irish’s subordinated bondholders”. In plain English: Anglo-Irish will default on some of its debt.

Credit Default Swap rate for Anglo-Irish Corporation subordinated bonds. Source: CMA