All-time highs for Portuguese and Irish 10yr yield spreads:

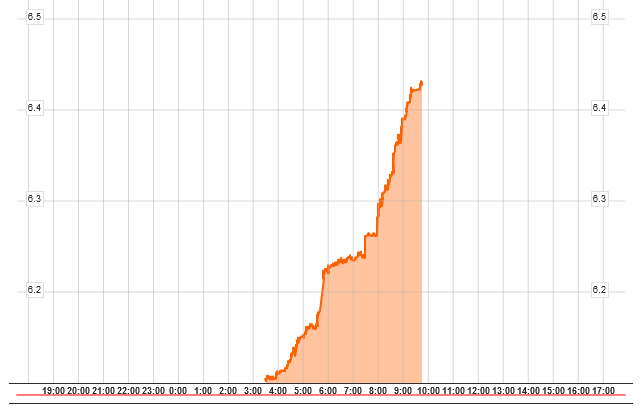

10yr Portuguese government bond yields – intraday September 20, 2010. Source: Bloomberg.

10yr Portuguese government bond yields – intraday September 20, 2010. Source: Bloomberg.

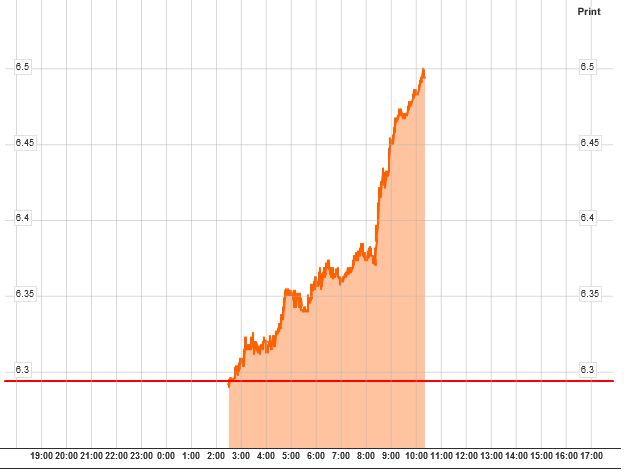

10yr Irish government bond yields – intraday September 20, 2010. Source: Bloomberg.

10yr Irish government bond yields – intraday September 20, 2010. Source: Bloomberg.

Market fears that tomorrow’s (9/21) EUR 1.5bn auction of fresh Irish debt (4 and 8 years) might not go well. Irish 10yr government bond yields 6.50% (+0.21) and Portuguese 6.43% (+0.35) hit both new record highs. Compared to those two bad boys Greece is a sanctuary of peace today – 10yr yields 11.55% (-0.02). The spread widening is happening despite the ECB (European Central Bank) being rumored to support Irish and Portuguese debt in the market.

The thing with the Irish debt auction is that they have the choice of either paying market rates (presumably above 6% for the new 8 year bonds) or asking the IMF or EFSF (European Financial Stability Fund) for help (and paying less interest, presumably 5%). Conveniently the two major rating agencies (Moody’s and S&P) today announced AAA-ratings for any future debt of the EFSF.

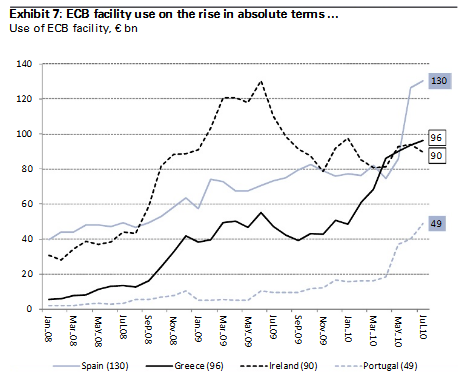

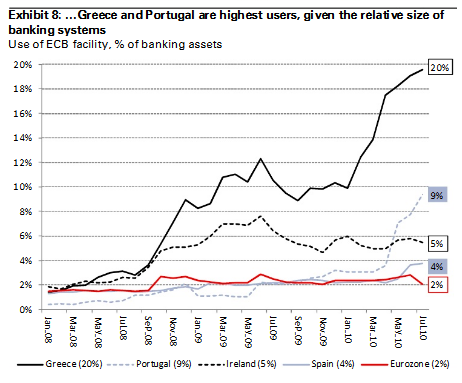

The extent to which some countries are dependent on financial help via the ECB is underlined by this: Greek banks have used EUR 96bn of ECB facility (July) or 20% of their banking assets. Portugal is next with 49bn or 9%, followed by Ireland (90bn or 5%). Without support from the ECB the banking systems of these countries would probably be bankrupt – together with the state that is supposed to rescue those banks.