According to rumors the BoJ (Bank of Japan) last night spent JPY 100bn ($1.16bn) on currency interventions. The Yen weakened by 3%. Will the BoJ be successful? The Japanese trade balance is positive by JPY800bn per month (or JPY 40bn per trading day) meaning they would have to buy half a billion USD per day just to neutralize those inflows.

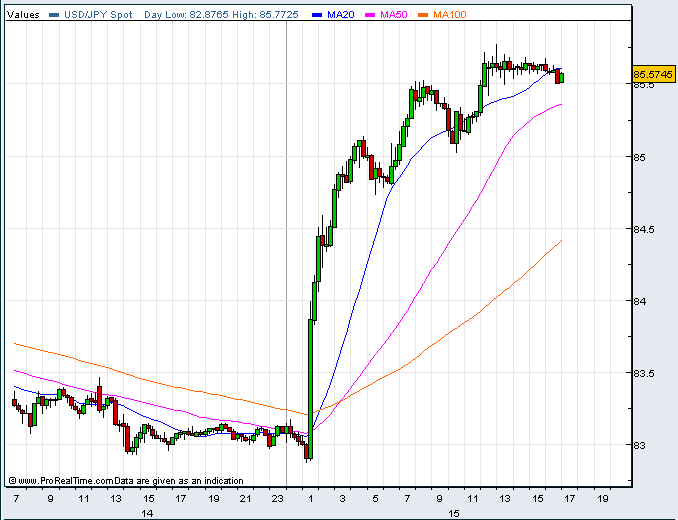

Japanese Yen per US Dollar. Source: FxStreet.com

Japanese Yen per US Dollar. Source: FxStreet.com

From January 2003 to March 2004 the BoJ spent JPY 35tn (then = USD 320bn) on interventions – and the Yen STILL rose by 13%. Same for the SNB (Swiss National Bank): recently spent $200bn (buy Euros, sell Swiss Francs) to weaken the Swiss Franc, but it rose 15% instead – and led to a loss on currency positions of CHF 11.2bn in the first half of 2010.

Today the Swiss National Union Organization called upon the SNB to intervene again to weaken the Swiss Franc (link).

Their chief economist, Daniel Lampart, is asking the SNB to define a target exchange rate of CHF/EUR 1.45-1.50 (currently 1.30) and to “defend it vigorously”.

Most people underestimate the amount of trading going on in currency markets (ca $4tn, yes, trillion, a day). It is a multiple of the actual flow of goods. No central bank stands a chance.

One way out would be to introduce a special, subsidized CHF/EUR exchange rate for Swiss exporters. The SNB (= the tax payer) would take the losses, but at least the profits would go to Swiss companies (and not international speculators). This of course would be another steps towards exchange rate controls, as seen in the 1970’s.