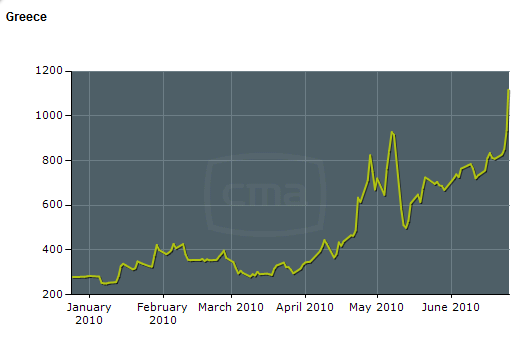

On Wednesday Greek CDS (Credit Default Swaps) blew out to a new record of 1,118 bps (+184):

Source: CMA

This implies a 68% likelihood of default, topping even Venezuela (59%) and Argentina (49%). With interest rates above 10% it is mathematically impossible for Greece to repay EUR 450bn of debt (or 150% of GDP). I assume politicians know that, and only passed the bail-out as a band-aid until French banks had unloaded their Greek government bonds to the ECB. The German banks were stupid enough to voluntarily promise not to sell any Greek debt. Unless they have unloaded their holdings secretly (possible, and would explain the drop in bond prices) or have bought insurance (CDS) there will be huge losses on their balance sheets.

Initially I thought Greece would be given 2-3 years to balance its primary budget deficit (excluding interest payments) and then default (strategically the right thing to do, since you don’t pay interest anyway when you declare default and with a balance primary budget you won’t need any external financing), but it might be too late and they might not make it until then.

So what are the options? You never know what kind of creative and truth-evading tactics politicians come up with, but usually one or more of the following happens:

1. Blame speculators, restrict free markets (e.g. short-selling) or even close markets

2. Throw more good money after bad money (force ECB to buy more Greek debt)

3. Bend accounting rules so banks do not have to recognize losses

4. Lower interest rates

5. Intervene in currency markets

6. Make strong-worded statements after economic summits (G20 this weekend) but fail to come up with any reasonable actions.

7. Should the public realize the extent of trouble and flee into gold, outlaw purchases of precious metals and imprison anyone attempting to buy or sell in the black market (See Franklin D Roosevelt’s executive order in 1933).

8. Declare war to distract the public and to justify more spending.