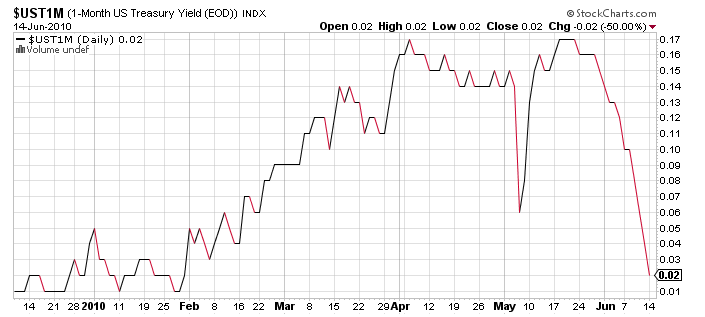

Look at 1-month yield for US Treasury bills: almost back to zero. Risk is out – everyone wants to be in a (presumably) safe place (even if there is basically no interest). $1,000,000 invested at 0.02% for one months yields less than $20. Pays for the cab ride home.

With Libor steady at above 0.5% the TED spread (see earlier post) continues to widen. Meaning banks prefer to give money away for (almost) free to the US government rather than lending it to another bank for multiple times the return. Who knows better what’s going on inside the banks than the banks themselves?