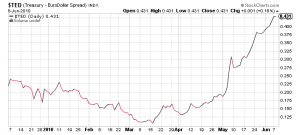

Introducing: the TED spread. It’s the difference between (formerly) risk-free 3-months Treasury Bills (hence the “T”) and the 3-months Eurodollar Libor (London Interbank Offered Rate, ticker symbol “ED”). The Libor is an average of interest rates banks charge each other for borrowing money. Currently 3-months Libor is at 0.54%, T-bills at 0.12%, hence difference = 0.42% or 42bps (basis points). A rising TED spread means banks are trusting each other less. Usually a sign of financial distress. We are not at post-Lehman levels (460bps) yet – but the continuous rise since March is a red flag: