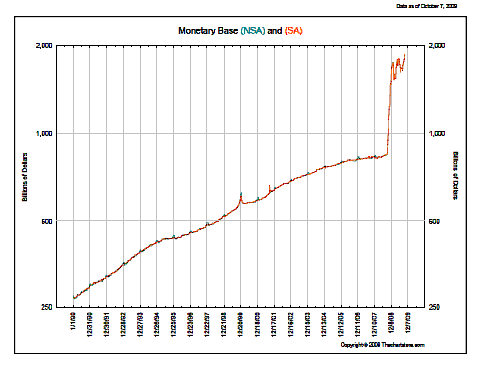

The US Monetary Base is still growing, …

Source: www.TheChartStore.com

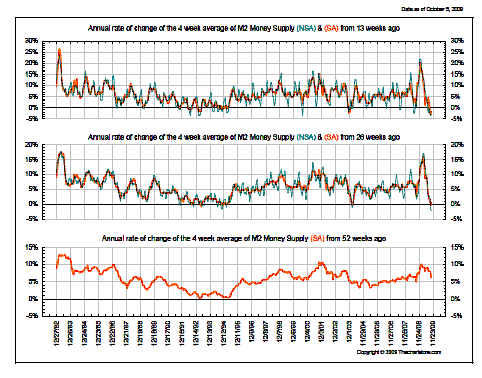

…but the growth rate is coming down, and has even turned negative:

Source: www.TheChartStore.com

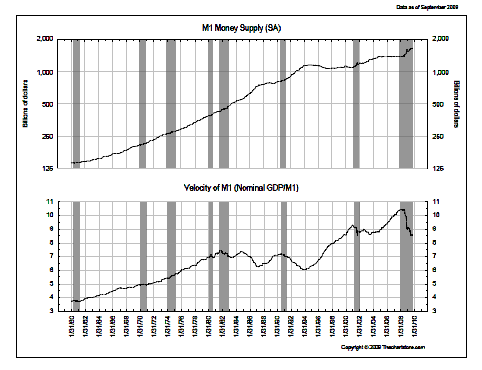

At the same time, the velocity of money (M1, M2) is still sinking:

Source: www.TheChartStore.com

What does this mean?

Take a look at the “Monetary exchange equation”:

MV = PQ, where

- M (money) is the total dollars in the nation’s money supply

- V (velocity) is the number of times per year each dollar is spent

- P is the average price of all the goods and services sold during the year

- Q is the quantity of assets, goods and services sold during the year

In layman’s terms, the amount of money in an economy multiplied with its speed (how many times it is being turned over within a year) equals real GDP times price level.

So, if you have constant monetary base (M) but increasing velocity (V) you can either have increasing real GDP (Q) or increasing prices (=inflation). Or a combination of both.

Usually central banks allow for some inflation and add some “slack” for increased velocity (due to financial innovations) and gently increase M over time.

After the subprime melt-down, velocity was significantly reduced (no more securitization of mortgages and company loans, hence a mortgage written stays on the books until maturity, with the money being “locked away” during that period).

Assuming constant M a strong decrease in V (like in Q4 2008) will lead to either a sharp contraction of Q (as witnessed by the strong decline of US GDP in Q4’08 and Q1’09) or deflation or both, which is not good.

Hence the strong increase in monetary base by the Federal Reserve Bank to counter these effects. Deflation must be avoided at all cost (it would bankrupt many companies, since their assets would decline in value, while debt remained same, hence equity would get squeezed until it was gone).

This is why the strong increase in M has not lead to inflation (at least so far) as its effect was offset by a declining V.

As banks are not increasing their lending and consumers are not in a position to increase spending the additional M has mainly ended up as banks reserves at the Fed, earning a risk-free spread. Parts of M have spilled over into assets like bonds (quantitative easing) and stocks.

Now, as the economy seems to stabilize, the Fed will try to “mop up” excess liquidity to prevent any future inflation potential from developing.

Conclusion:

As the growth in M stalls (or even turns negative) the period of sharply rallying stocks could be over. Long-term interest rates could increase as an important buyer steps away. Government funding needs will be elevated for years to come to finance deficits. Treasury purchases of foreign central banks could shrink (as US consumers reign into their spending, less goods from China will be imported into the US, leading to a smaller positive trade balance for China and hence less US Dollar receipts for them to invest in Treasury bonds).

With the gold market being too small to absorb all the speculative money currently rushing ashore, few investment options remain.

We currently prefer to earn money by writing call bear spreads with options on the S&P 500 index.

Alex Gloy

Lighthouse Investment Management