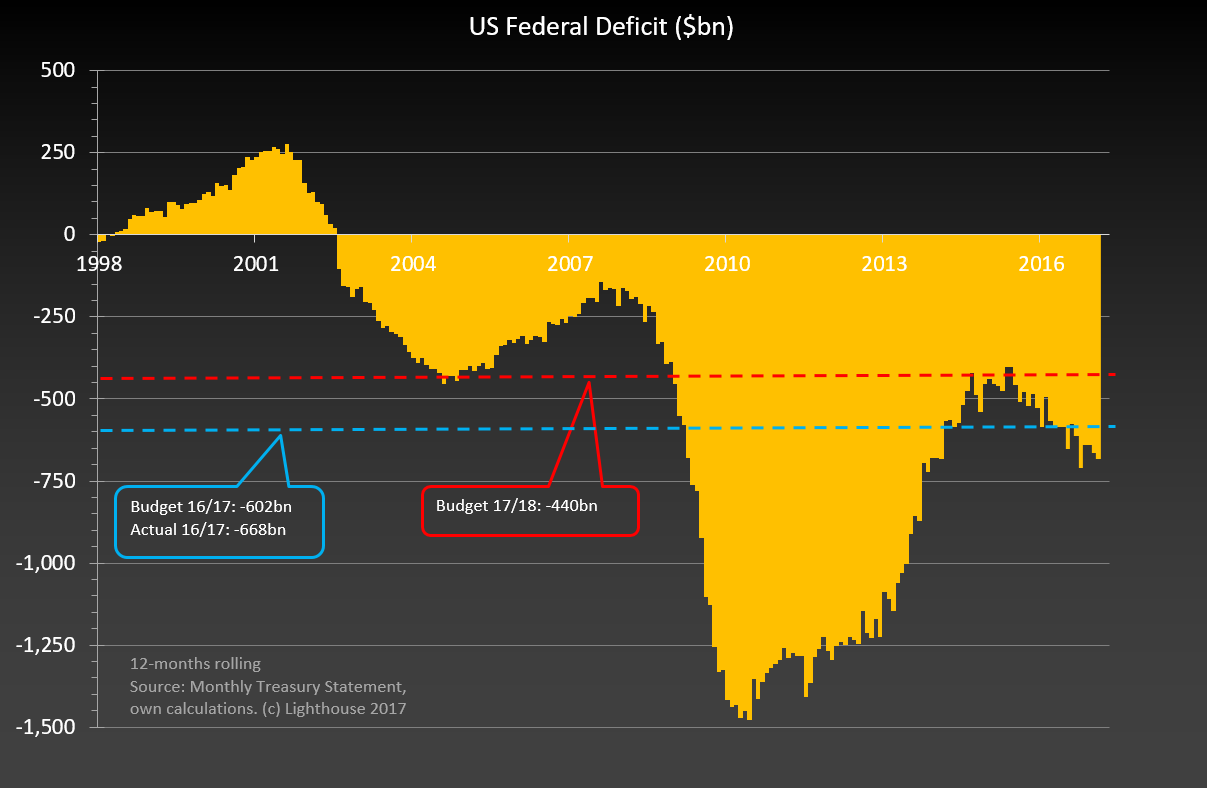

The US (federal) fiscal deficit has been deteriorating recently. This is an odd thing during the late stages of an economic recovery. The budget for 2016/17 (September 30) has been missed by around 10%, and the current fiscal year target (440bn) looks far off.

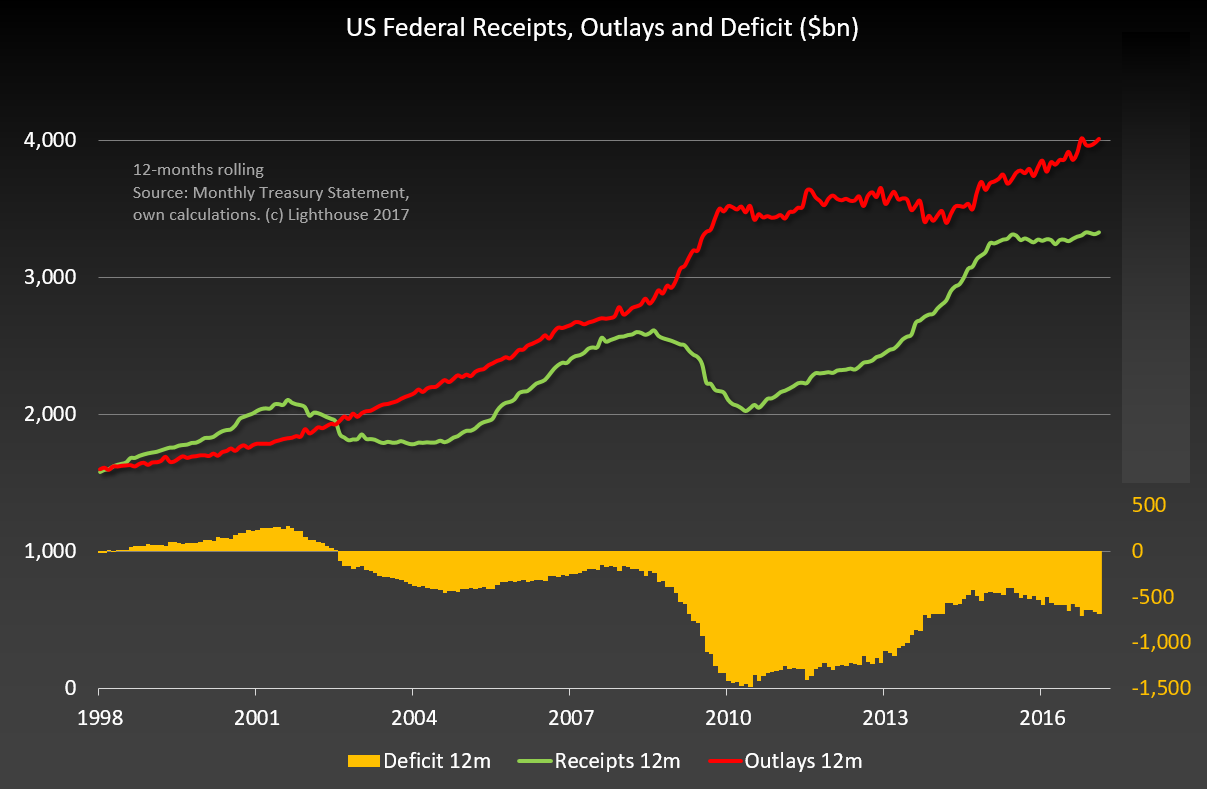

While spending continues to increase, receipts (government income) have leveled off since the beginning of 2016:

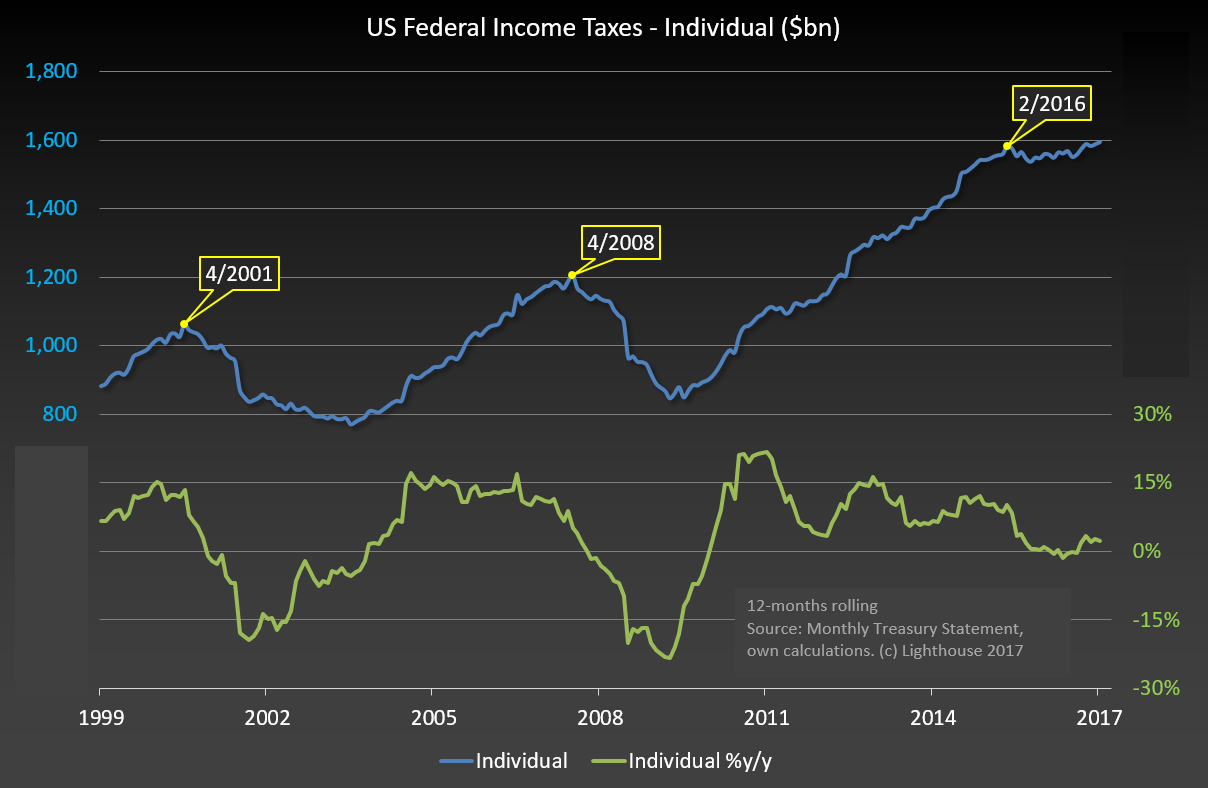

Individual income taxes have peaked at $ 1.6 trillion:

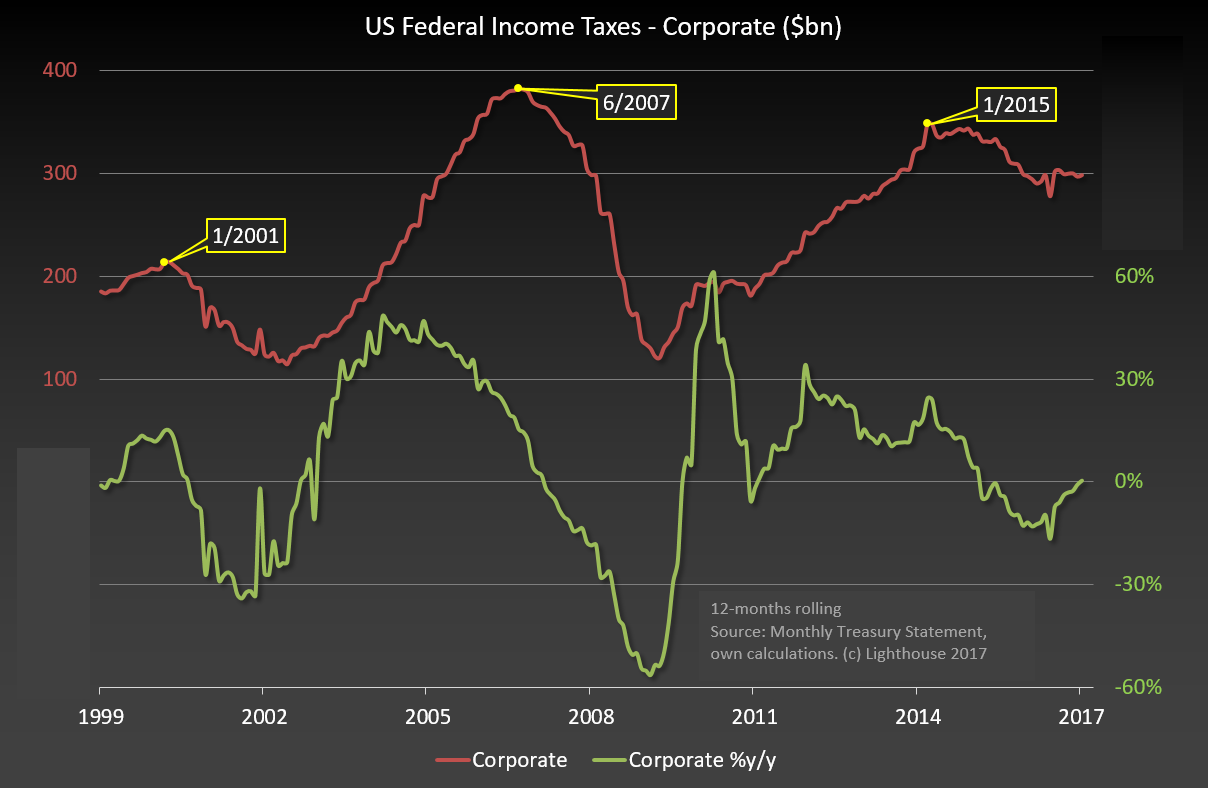

Meanwhile, corporate income taxes peaked in early 2015 and are now flat at $ 300 billion:

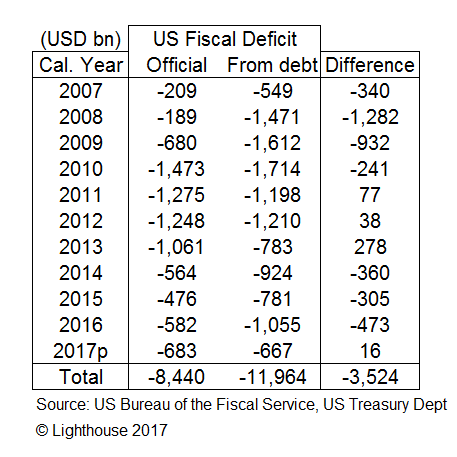

The deteriorating fiscal deficit, combined with a persistent trade deficit, would be bad enough. However, adding up the ‘official’ fiscal deficits since 2007, and comparing that number with the increase in federal government debt, something does not add up:

The fiscal deficit was actually 41% higher than stated. The difference stems from shifting certain expenses into “investments”.

With significant increases in spending on military, Veterans’ Affairs and Homeland Security the fiscal situation is likely to get only worse. Once foreign investors (private and central banks / sovereign wealth funds) stop financing the US twin deficits a current account crisis will occur. As the Federal Reserve is likely to keep a lid on bond yields the foreign exchange market will be the only available valve for adjustment. A significant devaluation of the US dollar is likely.