From FT’s Peter Spiegel:

“Alexis Tsipras, the Greek prime minister, has announced a national referendum on whether his country should agree to creditors’ demands that would release desperately-needed bailout aid to avoid national bankruptcy.

In a televised address to the nation after a late-night meeting of his cabinet, Mr Tsipras announced that the plebiscite would be held on July 5, a week on Sunday.

Mr Tsipras was unenthusiastic about the referendum, saying the creditors’ proposal was “blackmail” and an “indecent proposal”. But he said he would abide by the will of the Greek people as to whether to accept the agreement, presented at a meeting of eurozone finance ministers on Thursday.

In a sign of how tendentious the vote will be, Panagiotis Lafazanis, the leader of the hard-left group in Mr Tsipras’ governing Syriza party, announced he and his faction would not support a “yes” vote.”

This is the logical outcome of the situation Tsipras is in: if he accepts the Troika’s austerity measures he would break election promises (and would likely be blamed by his people for continued economic malaise). If he does not accept, Greece would likely face bankruptcy, a collapse of the banking system with subsequent loss of most (remaining) savings deposits.

So the “easy” way out is to ask the people. This way, nobody can blame Tsipras for the outcome. A smart move. And he waited until the very last minute, so he can claim to have gotten the “best and final” offer from Troika. It’s “take it or leave it”.

Here is the full text of Tsipras’ speech:

My fellow Greeks,

For the past six months the Greek government has been giving battle in conditions of unprecedented economic asphyxiation, to implement your mandate, of Jan. 25. It was a mandate to negotiate with our partners to end austerity and to restore prosperity and social justice to our country.

(It was) for a viable agreement which would respect both democracy, common European rules and would lead to a definitive exit from the crisis.

Throughout this negotiation period, we were asked to adopt bailout agreements which were agreed with previous governments, even though these were categorically condemned by the Greek people in the recent elections.

But we did not, even for a moment, contemplate yielding. That is, to effectively betray your own trust.

After five months of tough negotiations our partners, unfortunately, concluded at the Eurogroup the day before last with a proposal, an ultimatum, to the Hellenic Republic and the Greek people.

An ultimatum which contravenes the founding principles and values of Europe. The value of our common European structure.

The Greek government was asked to accept a proposal which accumulates unbearable new burdens on the Greek people and undermines the recovery of Greek society and its economy, not only maintaining uncertainty, but by amplifying social imbalances even further.

The proposals of the institutions include measures which lead to a further detribalization of the labor market, pension cutbacks, new reductions in public sector salaries and an increase in VAT on food, eateries and tourism, with an elimination of tax breaks on the islands.

These proposals clearly violate European social rules and fundamental rights to work, equality and to dignity, proving that the aim of some partners and institutions was not a viable and beneficial agreement for all sides, but the humiliation of the entire Greek people.

These proposals prove the fixation, primarily of the International Monetary Fund, to tough and punitive austerity.

It makes it more imperative than ever that leading European forces rise to the occasion and take initiatives which will draw a line under Greek debt, a crisis which also affects other European countries, threatening the future of European unification.

My fellow Greeks, we are now burdened with the historic responsibility, (in homage to) to the struggles of the Hellenic people, to enshrine democracy and our national sovereignty.

It is a responsibility to the future of our country. And that responsibility compels us to answer to this ultimatum based on the will of the Greek people.

A while ago I convened the cabinet, where I suggested a referendum for the Greek people to decide in sovereignty.

The suggestion was unanimously accepted.

Tomorrow the plenary of the Greek parliament will convene to ratify the proposal of the cabinet for a referendum next Sunday, July 5, posing the question of the acceptance or rejection of the proposal by the institutions.

I have already communicated my decision to the President of France and the German Chancellor, the President of the ECB, while tomorrow in correspondence to the EU leaders and institutions I will formally request a few days extension of the (bailout) program so the Greek people can decide, free of pressure or coercion, as is dictated by the Constitution of our country and the democratic tradition of Europe.

My fellow Greeks,

To this blackmail-ultimatum, for the acceptance on our part of a strict and humiliating austerity (proposal), and with no end to it in sight nor with the prospect of allowing us to ever stand on our feet economically or socially, I call upon you to decide sovereignly and proudly, as the history of Greeks dictates.

To this autocratic and harsh austerity, we should respond with democracy, with composure and decisiveness.

Greece, the cradle of democracy, should send a strong democratic answer to Europe and the world community.

I am personally committed to respect the result of your democratic choices, whatever those may be.

I am absolutely certain your choice will honor the history of our country, and send a message of dignity to the whole world.

In these crucial hours, we must all remember Europe is the common home of its people. There are no owners or guests in Europe.

Greece is, and will remain an indispensable part of Europe and Europe an indispensable part of Greece. But Greece without democracy is a Europe without identity or a compass.

I call upon you all to take the decisions worthy of us.

For us, future generations, for the history of Greeks.

For the sovereignty and dignity of our people.

Tsipras does not mention the consequences of a “no” vote. Instead, he speaks a lot about “sending a strong answer” to “autocratic and harsh austerity”, humiliation, dignity and sovereignty. He refrains from making any recommendation, but I think it is clear which outcome of the vote he favors.

The outcome of the referendum is uncertain. Most likely, it depends on which faction is more successful in motivating its supporters to show up at the ballot boxes. Is the fear of losing the Euro stronger than the indignity of accepting more austerity? Usually, when people suffer, those who are against something are more motivated than those in favor.

What about the EUR 1.5bn due to the IMF on June 30th? Greece is unlikely to pay, and Tsipras has asked the Troika for a few extra days of leniency (which they have little reason to refuse).

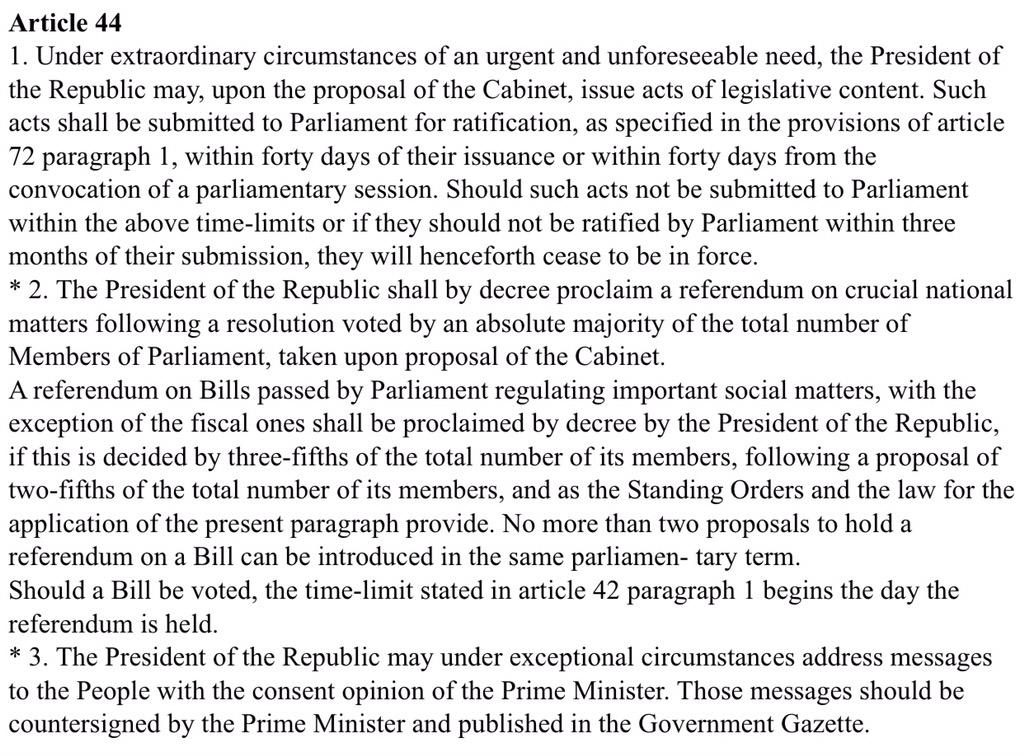

There is some discussion if this constitutes a “fiscal matter” and hence would not be eligible for referendum according to article 44 (so we could end up in high court if a legal battle breaks out):

There are reports on long lines at ATM’s (automated teller machines) in Greece to withdraw cash. Lines began to build shortly after midnight, immediately after the announcement of referendum. This will put more strain on the Greek banking system. The ECB will be forced to increase ELA (Emergency Liquidity Assistance) on Monday (unless it wants to be blamed to have pulled to trigger). The ECB has announced a conference call for Sunday (to assess the amount of cash outflows I assume). So far, Greek banks are planning to open on Monday, without any capital controls.

The ECB could, however, demand daily withdrawal limits in exchange for increasing the the ELA limit. But what if Greece refuses to enact those limits?

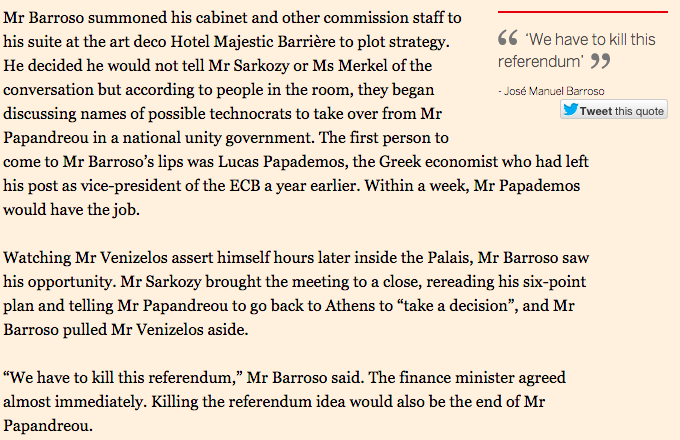

The last time Greece intended to hold a referendum (2011) it was killed by the EU within a week:

While still a possibility, I don’t think the Greek people would take such a development lightly at this stage.

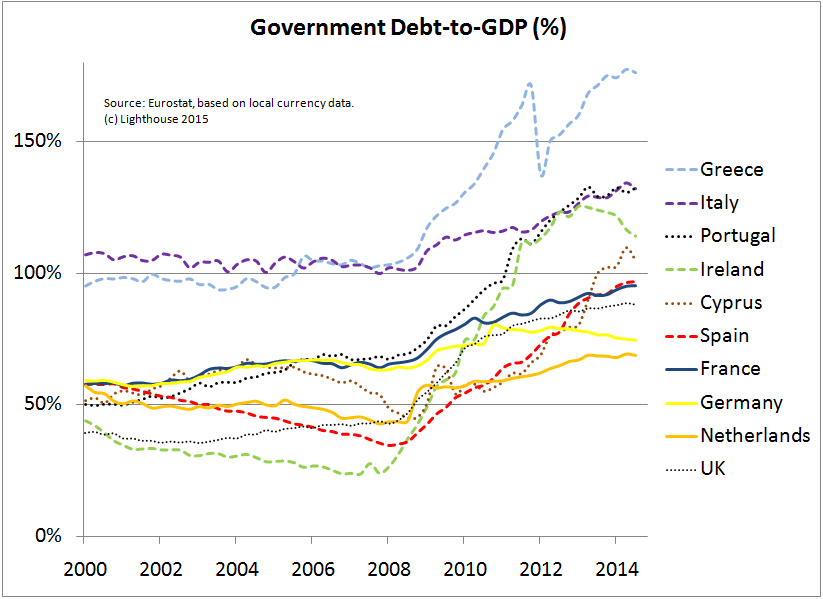

Could the referendum be cancelled by Tsipras? Only if the Troika agrees to a significant cut in Greek debt. This was a main request by Greece. It is a sensible request, since Greek debt-to-GDP is at 174%:

Even with a (proposed) budget surplus of 3.5% per annum it would take until the year 2047 for Greece to meet the Maastricht criterion of 60% debt-to-GDP. You simply cannot tell an entire generation their working life will be “lost” in order to pay back other countries’ taxpayers.

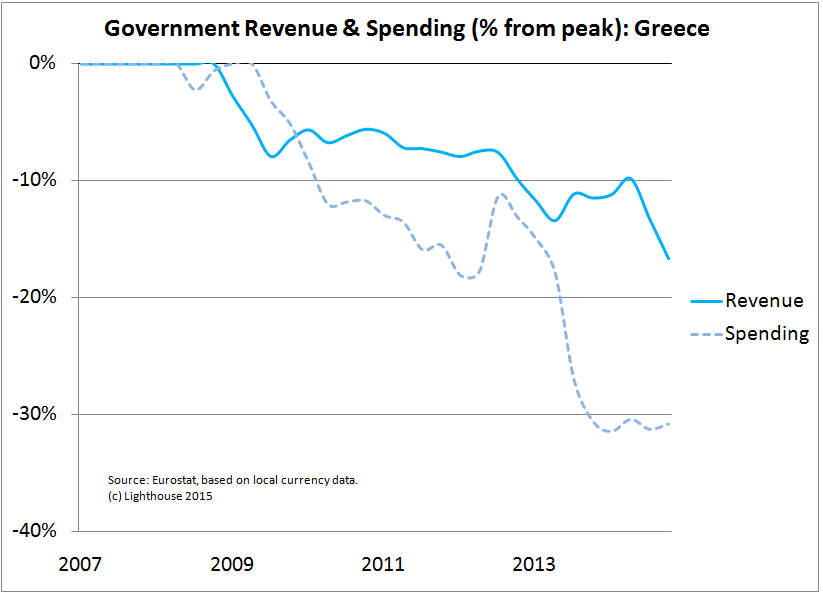

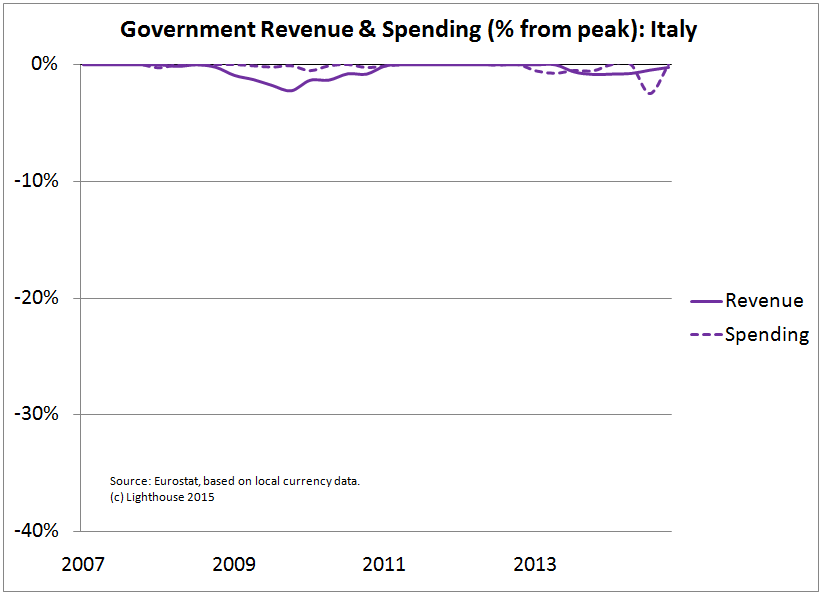

You cannot even blame Greece for not having cut government spending. It cut, by far, the most out of all European countries:

Compare to Italy, whose debt-to-GDP ratio is now (132%) already above the point where Greece was when the crisis began (127%):

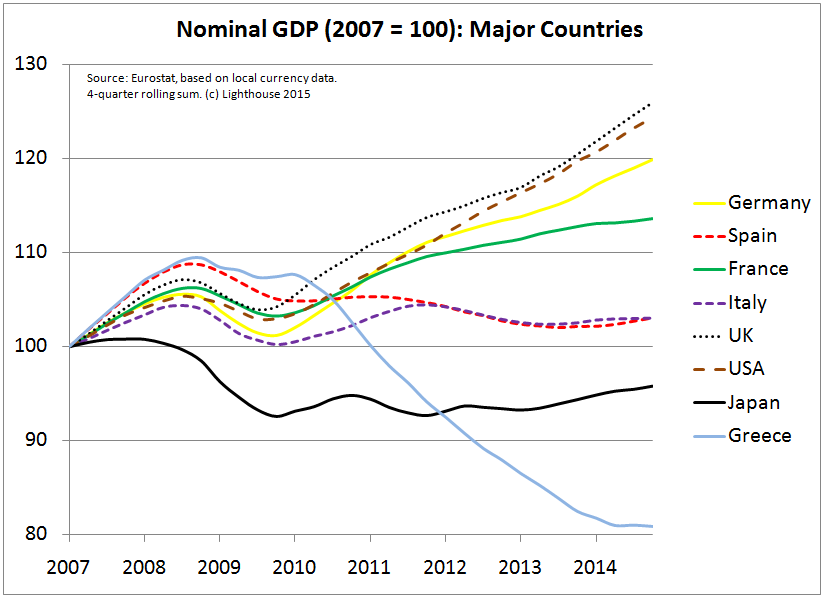

The problem in Greece is that it lost around one quarter of GDP since the peak:

That is a depression. Adding severe austerity onto a depression is plain stupid.

For a detailed account on what went wrong in recent debt negotiations you may want to read The Greeks deserved better than this by Nick Malkoutzis at MacroPolis.

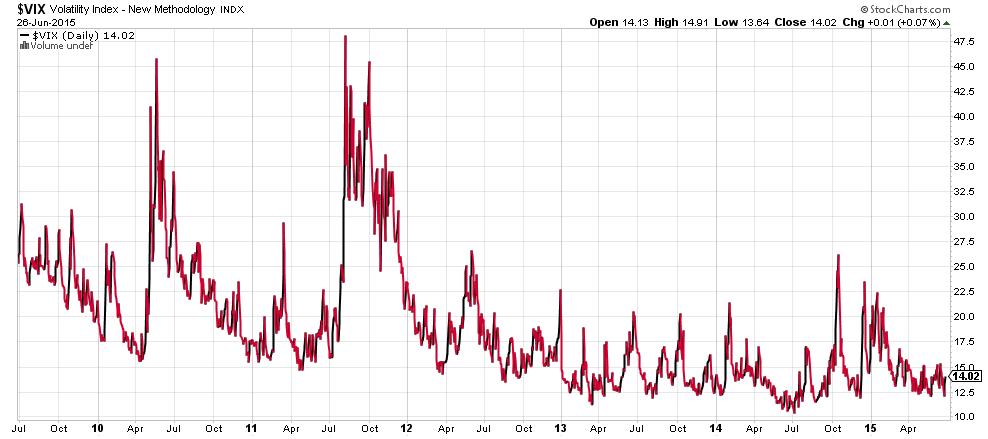

For financial markets, this development will come as a surprise. The VIX (volatility index) is near the bottom of its range over the past 6 years. It won’t be on Monday:

Demand for portfolio insurance will increase, making options (both puts and calls) more expensive. Rising volatility usually goes in hand with falling stock prices (chicken and egg question applies).

The Troika might have taken comfort in the fact that, so far, no contagion to other PIIGS (for example Spain, Italy and Portugal) was visible. This might change now.

It will be interesting to see what kind of scare tactics EU politicians will resort to in order to convince Greek people not to vote (or vote in favor of Troika’s proposal). Let’s hope that violence does not feature among those tactics.

Choices faced in referendum, as seen by Greek newspaper Kathimerini: