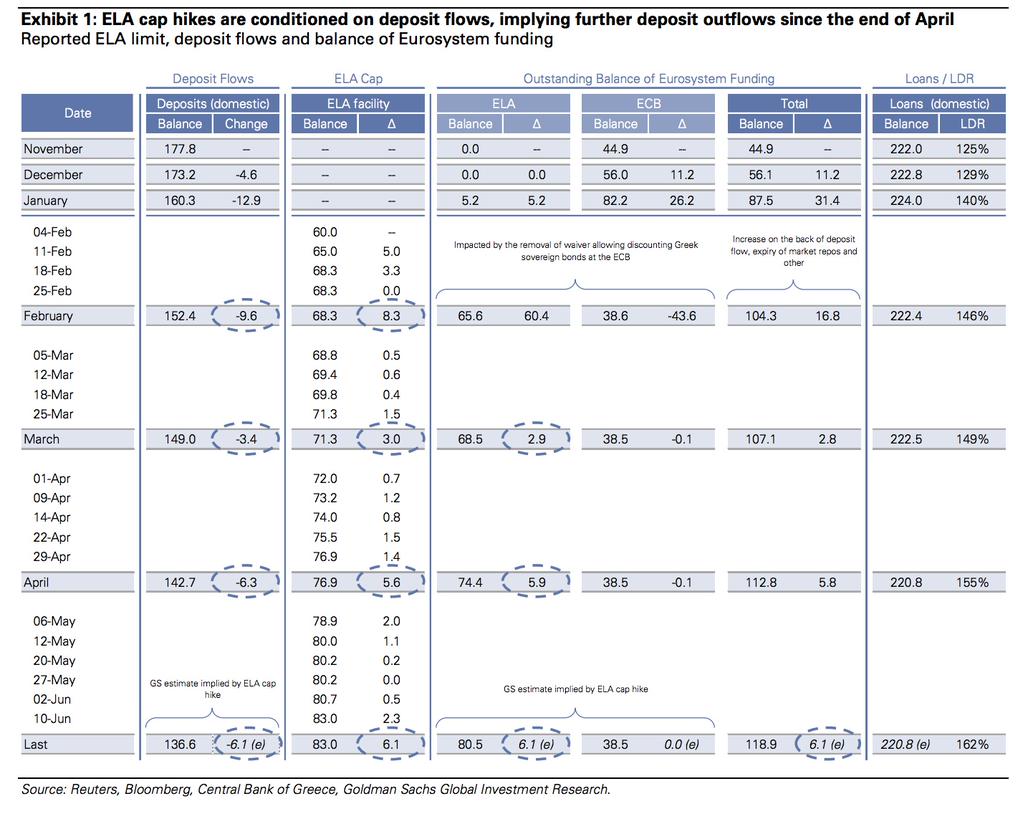

The ECB has painted itself into a corner. The table below is quite good. In the left column you see that customers have withdrawn around EUR 40bn from Greek banks since October 2014 (almost a quarter of all deposits). Capital flight is in full bloom. The ECB is keeping the Greek banking system alive by increasing Emergency Liquidity Assistance (ELA) every week. The increases correspond to the decline in deposits. Effectively, the ECB is enabling and financing capital flight.

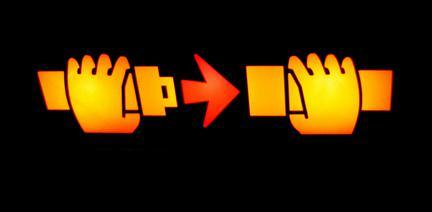

Meanwhile ELA has reached more than 50% (!) of all Greek deposits. If depositors needed to be “bailed-in” (as in Cyprus) there won’t be much left:

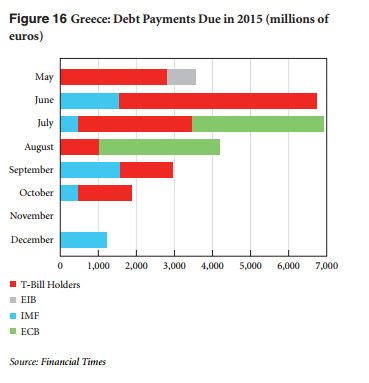

A Grexit now would not come handy for the ECB, as EUR 7bn were scheduled to be repaid by Greece over July and August:

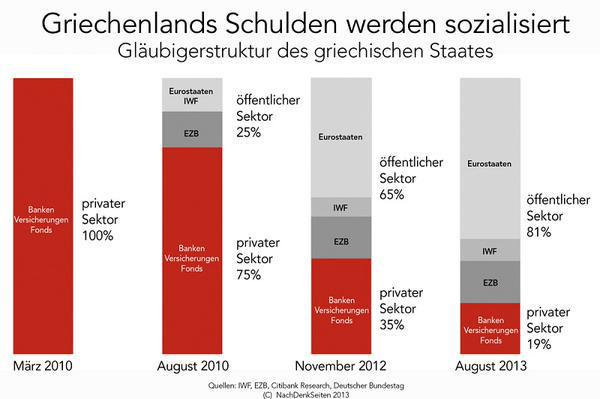

But is that really what matters? Or could it be that a Grexit now is finally ‘allowed’, after most Greek debt has been moved from the banking sector onto public creditors (= taxpayers)?

(red = private sector share, grey = public sector share of Greek debt)

A Greek default would be embarrassing for ECB, Euro-zone and the IMF, but is this how those institutions think? A default doesn’t mean they have to find additional funds to send to Greece; on the contrary – default means doing nothing. Nobody would have to fear any votes in national parliament or court challenges. So maybe it is the path of least resistance.

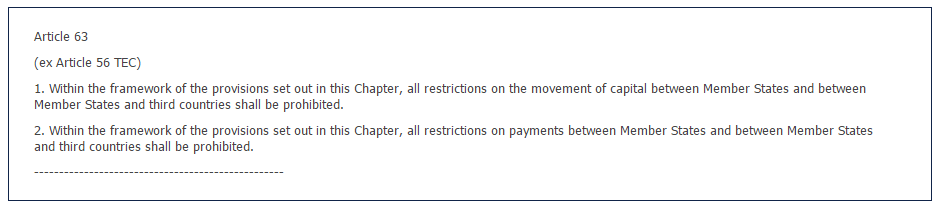

Let’s assume there is no agreement by Friday. Greece defaults, the ECB cuts off ELA, and Greece refuses to enact capital controls. Could the ECB cut off Greece from TARGET2 (the inter-Euro-zone payment system)?

Article 63 TFEU (Treaty of the Functioning of the European Union) states that any restrictions on capital movement are not allowed:

However I am sure politicians will find ways how to break the rules, once again.

Meanwhile, contagion is in full force. The yield on Spanish 30yr government bonds surged from 1.87% to 3.57%:

The 20-year Portuguese bond does not look better:

Volatility is going to increase further ahead of the weekend. Since nobody knows what is going to happen it is rational to bid up the prices for both calls and puts (so you are positioned for either outcome). This increases implied volatility, which makes insuring your portfolio against losses more expensive. Usually equity markets fall in times of increasing volatility (unclear which one is chicken and which one is the egg).