Some headlines rattling markets a bit, citing IMF spokesperson Rice:

* Greek bailout talks stopped amid failure to make progress

* There are major differences between the IMF and Greece in most key areas

* No progress in trying to narrow those differences

* Talks are deadlocked over taxes, pensions and financing

* Greece pension system is unsustainable; state is contributing 10% of GDP versus 2% for the EU

* Greece government should broaden the tax base; VAT structure is highly complex

* The ball is in Greece’s court

* All technical work with Greece is stopped; technical team has returned to Washington

* IMF MD Christine Lagarde will participate in EuroGroup meeting on June 18

COMMENT:

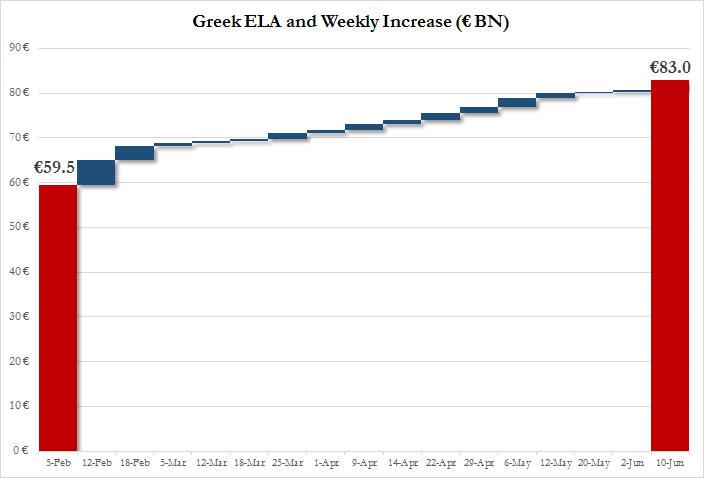

This is a serious breakdown of negotiations (and the IMF wants it to be seen as such). The IMF (and, most likely, the other creditors) are upset about Greece’s strategy of not agreeing to much reform, dragging out the negotiations and surviving thanks to ever increasing ELA (Emergency Liquidity Assistance) from the ECB:

The ECB is basically filling up capital fleeing from the Greek banking system. The amount has reached almost 50% of Greek GDP, a huge number. As Prof. Sinn pointed out in recent interviews, a Greek default would be costly as the ECB’s claim against the Greek banking system would not be worth much.

Greece is bankrupt, and everybody knows it. Mrs. Merkel had hoped to keep Greece (financially) alive until all Euro-zone debt was to be merged into common Euro Bonds. But time is running out, and Greece is not cooperating.

What can be done to avoid a default?

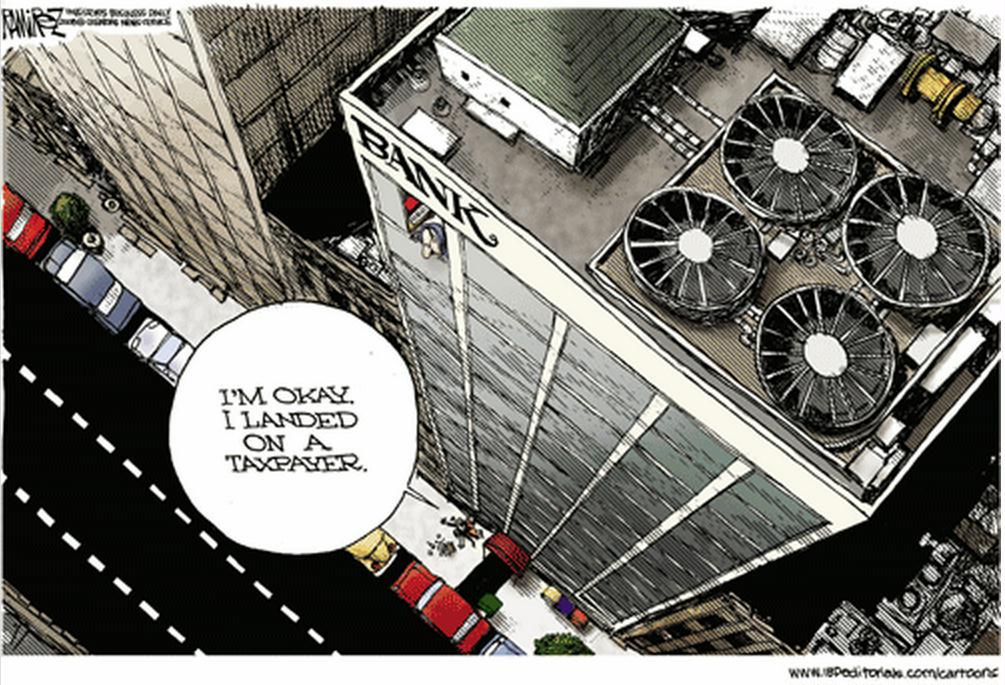

The Troika (IMF, EU, ECB) will have to announce a debt moratorium, suspending all payments until a later date. They will be embarrassed, but what can they do? It will be interesting to see if the IMF will be able to get out (at the expense of EU and ECB), but that’s a detail.

The Greek bailout was botched from the beginning. The ECB made a particularly stupid move by buying Greek government bonds in the secondary market. It didn’t provide any fresh money to Greece, but effectively subordinated all other holders of Greek bonds. A first debt restructuring was only allowed to happen once German and French banks were able to get their Greek loans off their books. They might have collapse otherwise, which is a worrying fact in itself. The ECB excluded its holdings from restructuring, making the necessary haircut for everybody else even harsher.

The ECB then repeatedly lowered its standards for acceptable collateral, finally ending up with junk-rated Greek bonds, only to exclude them again at the worst possible time.

The Greek debt fiasco will go down in history books as an example of how *not* to do it. It almost caused the Euro project to collapse, which would have thrown back Europe decades on its path to unity.

The EU, with roughly 500 million consumers, is the area with the most purchasing power in the world (and the only one able to oppose the United States). If the Euro project fails, Europeans have only themselves to blame.