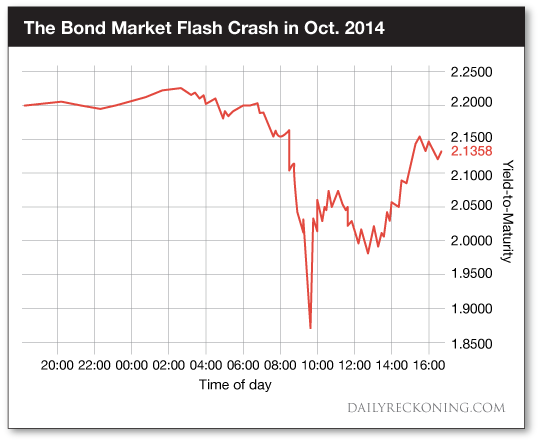

Interesting article by Jim Rickards on falling bond market liquidity. He cites the flash crash in US Treasury bond yields last October:

Falling yields mean rising bond prices. So the flash crash in yields actually was a flash rally in prices. Usually, investors only get hurt when prices fall (apart from a few short sellers). Because the vast majority of investors are long-only. So a flash crash in yields might have caused some head scratching, but no systemic damage.

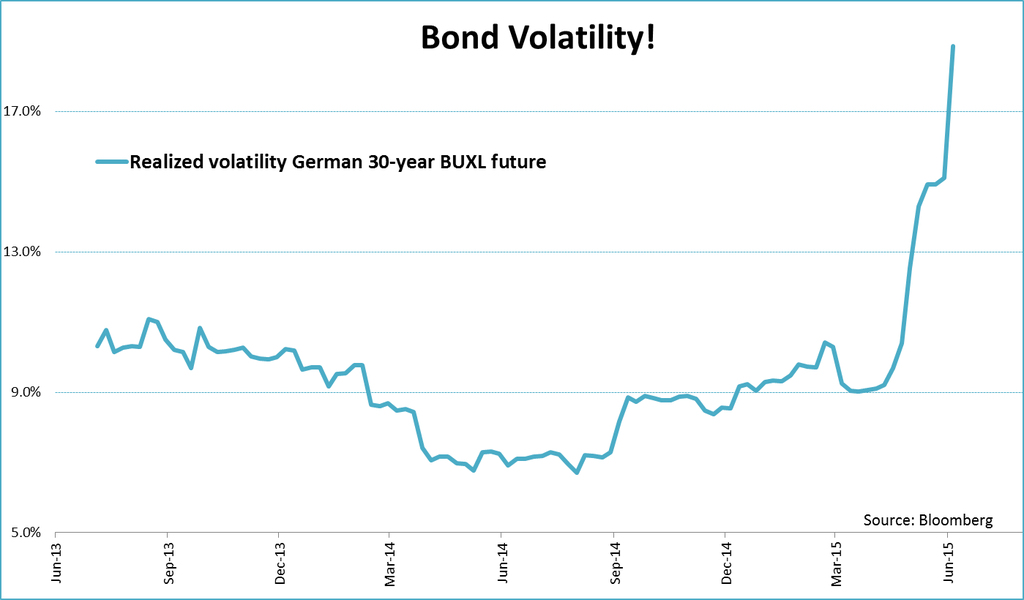

However, the story might be different once bond prices are crashing (= rising yields). The German 10-year government bond yield has already risen from 0.05% to 1.05%. The volatility of the BUXL future (underlying = 30-year German government bonds) is now exceeding that of stock indices. Meaning that, from a risk manager’s perspective, the 30-year German government bond is more risky than a stock market investment.

(h/t @JSBlokland)

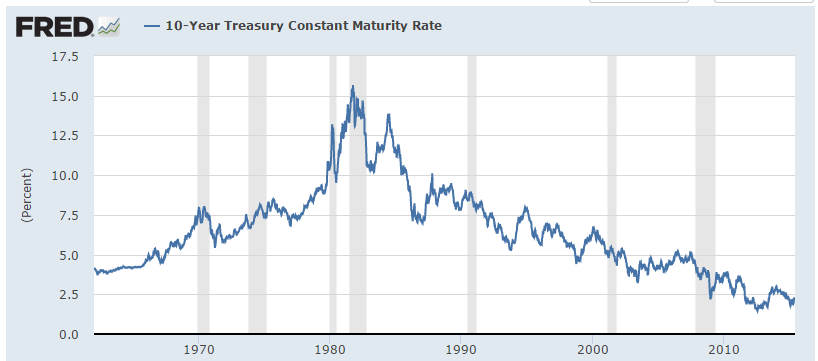

For the past 34 years, investors and borrowers have only known falling bond yields (with brief interruptions). Treasury Bonds once yielded over 15%. Very few in the business today remember those times (I happen to remember buying a corporate bond yielding 11% in Deutschmark in 1981 or 1982).

There is no collective memory of painful episodes (via losses) in the past. Brains have been conditioned by recent history. “All-weather funds” or risk parity strategies (“hedging” stock market exposure by leveraged bond market investments) are everywhere. Insurance companies, pension funds, bond fund managers and private investors are searching for yield in despair. Projects and companies are able to access financing that would normally not have been able to do so. This period of easy / free money guarantees bad investment decisions, which will come to haunt in the near future.

A side note: The US government will always be able to finance its debt; the group of “Primary Dealers” (P/D) is required to purchase any securities the US Treasury sells, even if other investors do not want them. Those primary dealers cannot run out of money, since the Federal Reserve Bank may lend them money via its Primary Dealer Credit Facility. It’s a perfect circle. The US government cannot go bankrupt. P/D’s will always buy its bonds, and the Fed will always extend credit to the P/D’s if things get dicey. What happens to the Dollar, however, is a different story.