According to data released by ACEA (European Automobile Manufacturers’ Association) new passenger car registrations fell 8.9% in August after a decline of 7.8% in July.

European car markets are quite diverse; it makes more sense to look at them individually:

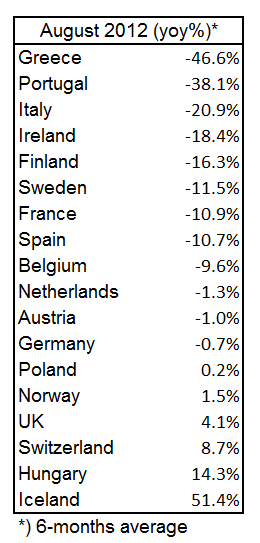

The PIIGS are firmly in control of the bottom (what’s up with those Nordics, Sweden and Finland?). Of the major markets, only the UK and Switzerland (thanks Mr. Jordan for the EUR/CHF peg) are in positive territory.

IMF-rebel Hungary seem to be doing fine while bail-out-escapee Iceland is shooting out the (head-) lights (with a total of 473 cars registered in August).

For trend analysis we look at 12-months moving averages, with 2007 = 100.

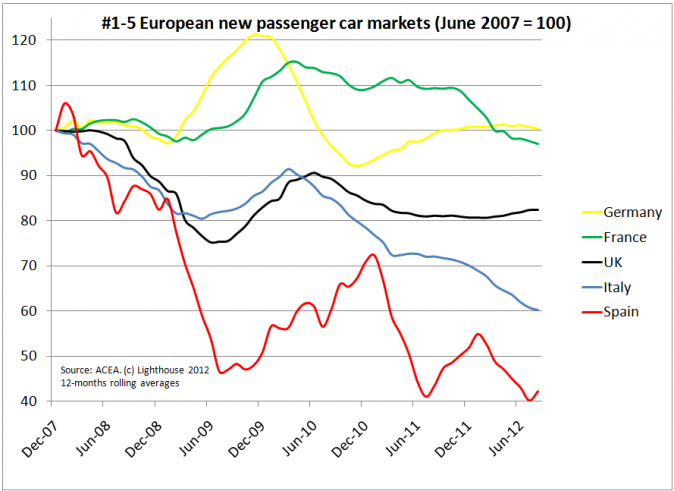

The top 5 markets by volume are Germany, France, UK, Italy and Spain:

Italy and Spain are showing little signs of recovery after shedding 40-60% of their 2007 registrations. Germany held up well, but has joined France in trending lower. The UK is holding up well considering it being in a recession.

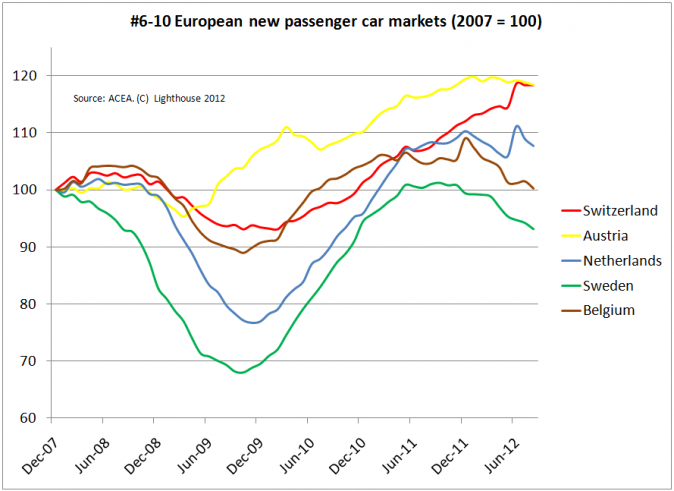

Markets # 6-10:

Sweden, Belgium, Austria, and, to lesser extent, the Netherlands are rolling over. In Switzerland, consumers rushed to purchase imported cars as dealers had to pass on currency gains from Swiss Franc strength.

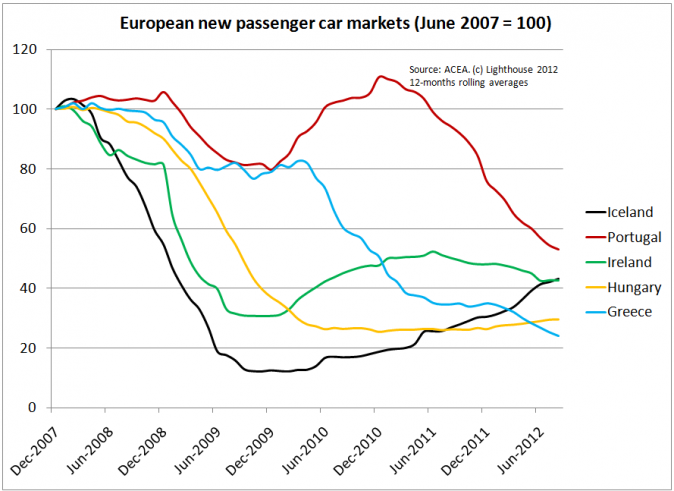

Finally, these fine markets:

Countries bail-out with EU taxpayer money (Greece, Ireland, Portugal) display worsening trends. Non-bail-out countries like Iceland and Hungary had initially larger drops, but are on a recovery since then.

In 2011, Germany produced 5.8 million passenger cars, of which 77% (4.5m) were exported, making cars and parts the most valuable export good (EUR 185bn). Europe absorbs 60% of those exports. Almost a quarter of exports is going to the UK, with a similar amount going to China and Taiwan.

Conclusion: A heavily export-dependent German automotive industry looks vulnerable to setbacks in important markets.

.