Two volatility ETFs (VXX and UVXY) are having almost half of the trading volume in the world’s largest ETF (SPY). How come?

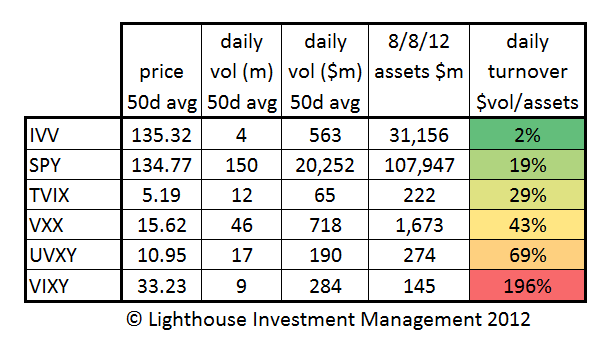

First, the facts:

SPY is heavily traded (19% of assets daily turnover) compared to IVV (also referring to the S&P 500).

But then come the volatility ETFs. Tiny VIXY (assets $145m) turns itself over 2x per day.

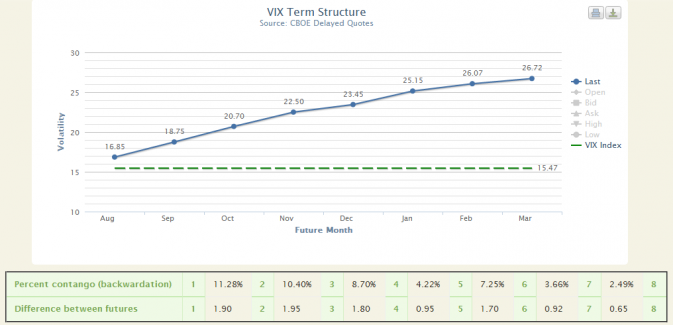

Why are those long-volatility ETFs so popular, given they are wasting assets in an environment with a steep volatility-futures curve (source VixCentral):

(Ceterus paribus short-term long-vola ETF’s will suffer monthly roll-losses of 11% or roughly 0.5% per trading day)

The most likely explanation is that volatility-ETFs offer leverage without the need for margin:

On August 9, 2012, SPY had a trading range of 60bps. VXX offered 220bps, topped by UVXY with 440bps.

Tiny moves in the equity market can be amplified by using volatility ETFs (not that I would endorse this). It’s leverage without leverage for the day trader.