A picture says more than a hundred words, so I wanted to present in graphical terms what happened at the Swiss National Bank over the last few quarters.

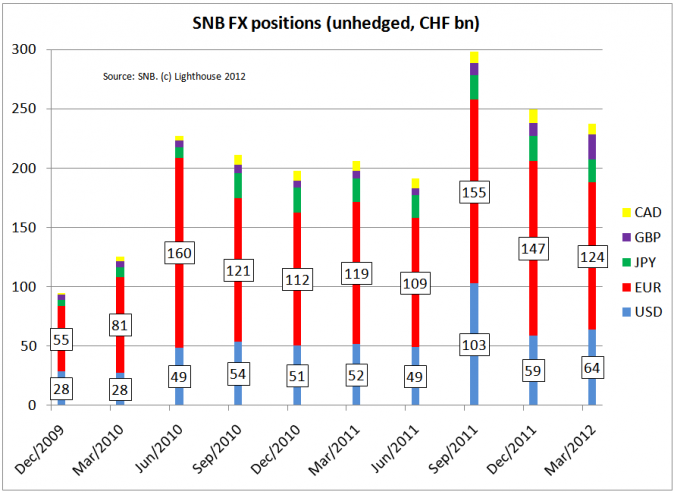

Unfortunately, the SNB does not provide foreign currency positions including derivatives on an absolute basis, but here are the unhedged figures:

- The SNB increased FX positions from less than CHF 100bn at the end of 2009 to 300bn (or 60% of GDP) in Q3 2011. That is a pretty large amount for a small country (boils down to CHF 50,000 for each Swiss citizen).

- During a turbulent Q3 2011 the SNB enacted a peg with the Euro (1.20) after the Euro briefly reached 1.0067 on August 9.

- The SNB also bought a lot of USD (doubling its holdings in Q3) after the USD fell to a low of 0.73 on August 9.

- Overall, the SNB unsuccessfully tried to stem the rise of the CHF versus the Euro since the beginning of 2010, leading to large losses.

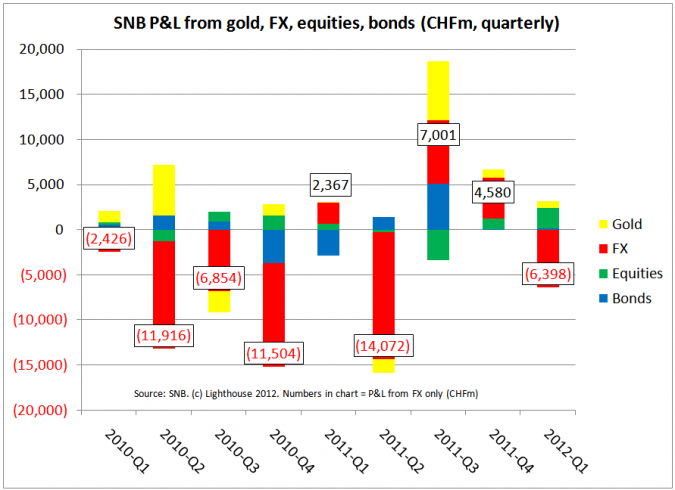

- A break-down of the most important items in the quarterly profit and loss statements by the SNB:

- Gold (yellow) is valued mark-to-market and has a significant impact on the P&L

- As the SNB invests in foreign bonds (blue), a price impact occurs when yields change

- The SNB also seems to have a large position in equities (green); in Q3, major stock market indices declined by 11% (SMI), 14% (S&P) and 25% (Dax). Assuming an average decline of 15%, the SNB must have had CHF 20bn invested in order to lose 3bn (as seen in Q3 2011).

- The largest impact, however, comes from FX positions (red). Over 5 quarters (Q2/2010-Q2/2011) the SNB lost CHF 42bn or 8% of GDP. This is a huge amount, normally seen only during a severe banking crisis (costs of bailout).

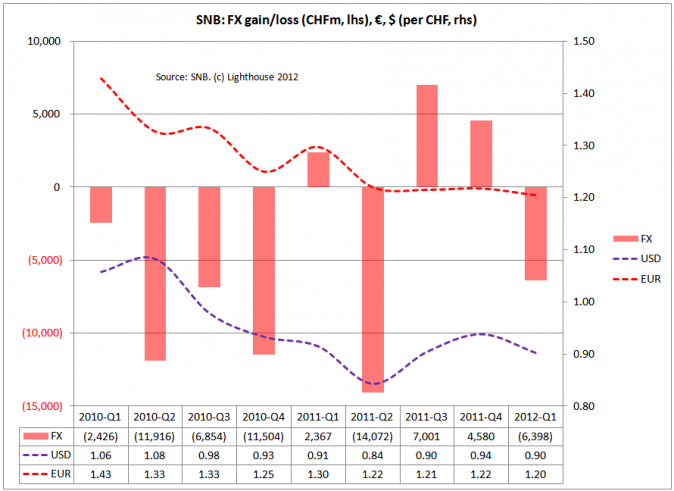

- Here’s a chart of just FX profits and losses (the red bars from the above chart), together with respective exchange rates of the USD and the EUR per CHF:

- The profits in Q3 and Q4 2011 must stem from the movement of the USD versus the CHF (as the EUR/CHF rate was didn’t change much – thanks to the peg; see right-hand scale for FX rates)

- Should the peg break, and exchange rates revert to the lows seen on August 9, 2011, the SNB would lose serious amounts of money on foreign currencies as well as gold (assuming gold price in USD being equal; a strong CHF translates into a weak gold price in CHF).

- To keep it simple, I assume the Swiss Franc would appreciate across the board against all currencies. The SNB currently holds CHF 245bn worth of foreign exchange plus 49bn in gold, so let’s say 300bn. A 10% revaluation would hence result in losses of CHF 30bn, a 20% revaluation in 60bn.

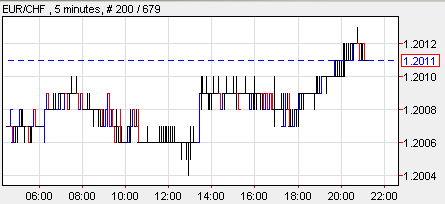

- The SNB is in a tricky situation. On June 4, the Euro fell again dangerously close to the peg:

- “Recycling” of Euros into other currencies risks alienating other central banks. Remember, when the SNB announced the Euro-peg, the ECB’s press release was not very cheerful (“took note of the decision”). The SNB cannot expect any love from other central banks, as no one wants to have a strong currency.

- Should other central banks “fire back”, the SNB stands no chance (due to the small size of Swiss Francs among international currencies).

- Should the Euro crisis escalate further, the peg will get attacked.

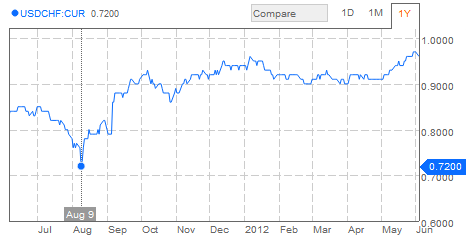

- It is worth noting that the USD has appreciated versus the Swiss Franc by 31% since the lows of August 2011 due to the Euro-peg (a weak Euro “dragged” the CHF down versus the Dollar):

- From a Dollar-perspective the Swiss Franc and/or Swiss assets (real estate) might look attractive at current exchange rates and attract buyers.

CONCLUSION:

Central banks have tried to “manage” currencies in the past. Sooner or later, market forces win. As all other major central banks keep printing additional Euros, Dollars, Yen etc., the SNB looks prone to lose this game. A run on the Swiss Franc could lead to a further increase in prices of Swiss government bonds. Swiss equities however would decline, at least measured in Swiss Francs.