The official version:

- “Enormously dedicated” SNB chairman Philipp Hildebrand purchases 500,000 USD days before he devalues the Swiss Franc by 10%.

- This plain-vanilla spot currency transaction becomes “water cooler” story at Bank Sarasin (which wouldn’t even open accounts below 1 million minimum deposit).

- An IT employee takes pictures of incriminating documents, briefly weighs the consequences of breaking Swiss banking secrecy, deems the latter porous as Swiss cheese, find it his patriotic duty to “turn in” the SNB chairman. However, to his surprise, breaking banking secrecy is still frowned at by the Swiss people. The misunderstood Robin Hood contemplates suicide and enters a mental institution.

- Hildebrand, after initially fronting his wife to sort out the mess, retro-actively donates 75,000 front-running profit from the transaction that was meant to finance his wife’s art gallery.

- In an ultimate act of heroism, Hildebrand decides to step down despite earlier assurances to the contrary.

- In a teary-eyed statement, the SNB’s surviving members decry the “loss of an outstanding central banker” (probably referring to his entry in the Guinness Book of Records for greatest amount ever lost with FX interventions over 18 months – CHF 29bn or 6% of GDP). In the heat of the moment, mention of any regrets about Hildebrand’s departure gets sidelined.

- Thomas Jordan, the vice-chairman, takes over the wheel. He continues Hildebrand’s franc-not-too-fort-policy (keeping peg-attacks at bay by regularly threatening to destroy the country’s currency by printing unlimited amounts).

- A trainee continues to watch the EUR/CHF rate in overnight trading and sells the occasional Swiss Franc or two.

The alternative version:

- Members of the SNB council realize Hildebrand blew CHF 29bn so his daughter wouldn’t discover daddy (despite having been groomed at hedge fund Moore Capital) sucks at FX trading and created losses in her account.

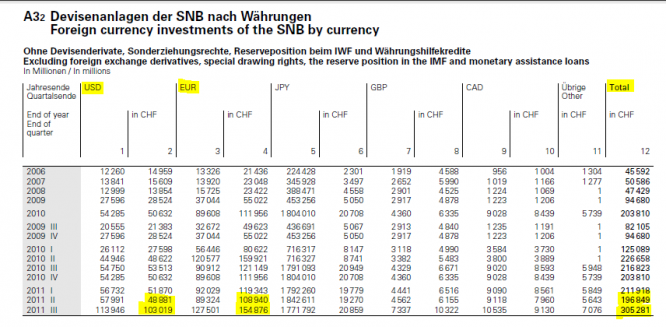

- September 6, 2011. After wing man “negative equity doesn’t matter”-Jordan makes sure they won’t be sent to prison for this, crazy Phil goes nuclear and threatens to buy every Euro coming his way. Which he does; with 19 trading days remaining in the third quarter, the SNB expands its FX holdings from CHF 197bn to 305bn (goes on shopping spree for 46bn Euros and throws in 54bn worth of Dollars for good measure):

- Toward the end of 2011, PriceWaterhouseCoopers asks how the SNB’s contingency plans for a Euro break-up are doing and if they had a garbage dump large enough to accommodate their CHF 150bn worth of Euros.

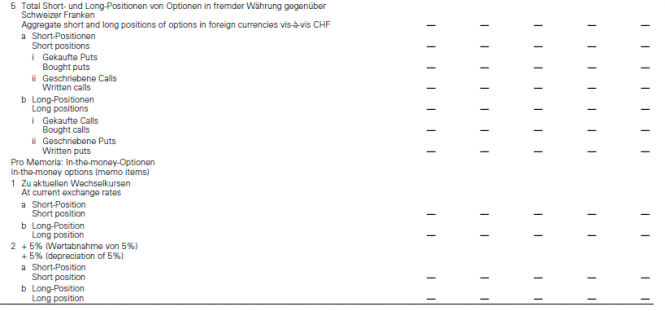

- PWC also wonders what happened to all the naked puts and volatility forwards the SNB was reportedly selling according to a Reuters report on September 8, citing “about 10 option traders at major banks in Asia and Europe” (source). Because the SNB balance sheet per November 30 simply shows a sea of dashes:

- On the other side of those “invisible” (read: off balance sheet) derivative trades are, of course, former colleagues and friends from the hedge fund world.

- A couple of SNB council members realize the scope of the looming disaster. They decide Hildebrand must go.

- The SNB is now ripe to be plundered. Time for Hildebrand to hit the eject button before the keg – excuse me, peg, explodes.

- Thanks to an endless supply of Euros courtesy of the ECB, hedge funds using 100 times leverage fill every SNB bid. The ensuing inflation of the Swiss monetary base destabilizes the country; the entire SNB council is fired.

- The peg breaks, the Swiss Franc surges 20%, leading to combined currency losses of more than 10% of GDP. Switzerland makes a beeline for help from the IMF.

Which story-line is more realistic?

The Swiss had a rough couple of years; first the national airline crashes, then the banking secret, and, now, their central bank. It seems someone from inside the SNB finally woke up and skilfully played the Swiss media to work on Hildebrand’s expulsion.

There is only one problem for the SNB: how to get out of the hole before the Euro blows up?

The sharks are already circling their prey; the Swiss Franc decoupled from the Euro the moment SNB chairman Hildebrand resigned:

The exchange rate got dangerously close to the “Rubicon” of 1.20 (the level the SNB vows to defend with utmost determination). The SNB is basically 100 pips away from extinction.