Australia is the sixth-largest country (2.9m square miles) on earth, just a tad smaller than the contiguous United States (3.1m). They are a little short on people (22.8m), which comes handy, since they dig up their entire country and sell the dirt to China.

Australia has a remarkably low government debt-to-GDP ratio (29% ), low unemployment (5.2%), a moderate budget deficit (3.4% of GDP) and moderate inflation.

However, Australia has been running current account deficits of up to 6% of GDP for more than 50 years. The “mates”, until recently, didn’t like to save, hence most investment has to be financed by borrowing from foreigners.

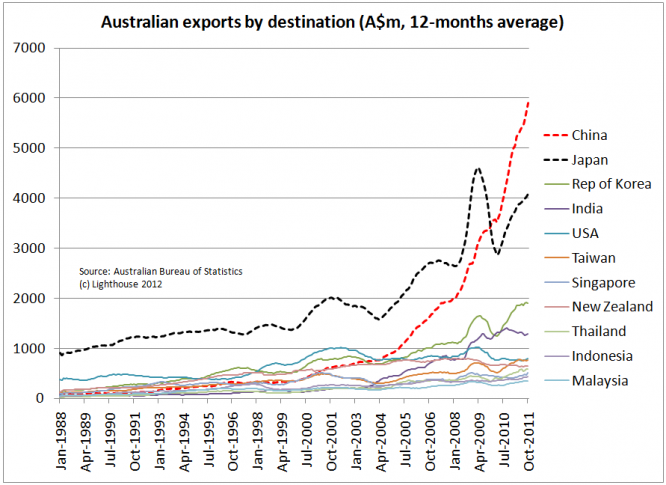

I was curious as to how much of the success was due to exporting dirt to China. From the Australian Bureau of Statistics you get the following data about their top-10 export markets (accounting for 82% of all exports):

A bit more than half (50.2%) of all exports go to two countries: China and Japan. If you stripped out those two, there wouldn’t be much growth left.

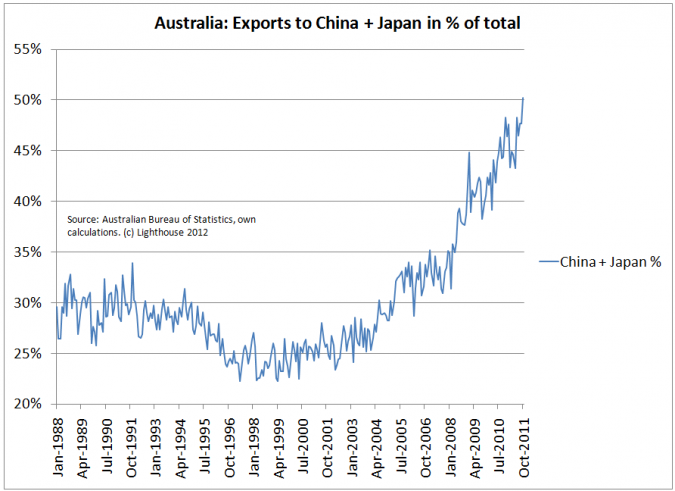

The dependence on China and Japan has doubled over the last decade:

Over the last 12 months, total exports grew by A$ 35.6bn. Of that growth, 24.2bn, or 68%, came from China and Japan.

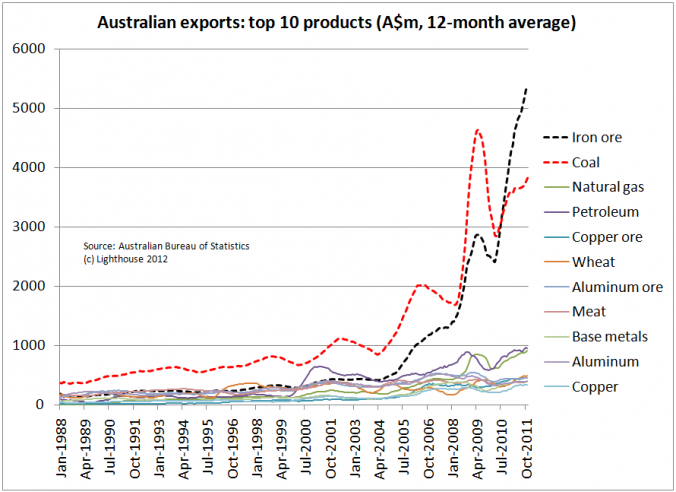

Let’s look at exports by product. Here are the top-10:

Two products (iron ore and coal) account for 47% of all exports.

Australia is a 2-product, 2-customer wonder. If either China or Japan has a problem, so does Australia.

To import a car (let’s say 2 tons, $30,000), Australia has to export 214 tonnes of iron ore or 248 tonnes of coal, leading to unfavorable the terms of trade.

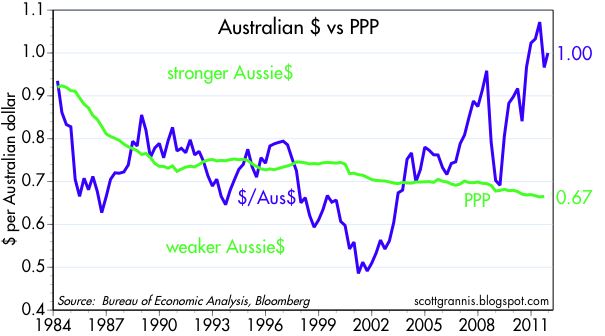

As Scott Grannis recently pointed out, the Australian dollar trades far above its purchasing power parity:

Putting all eggs in one basket will come to haunt Australia once Japan and China collapse under the weight of their debt. A much lower Australian dollar would then be needed to make other goods attractive for exporting.