Whenever you come across a mystery in finance there always is an explanation. Like the question why the ECB would so ferociously resist any “haircuts” on Greek debt. Despite all the evidence that current debt, now expected to peak at levels exceeding most calculators’ capacity, is unsustainable.

Why would the ECB, the largest single holder of Greek debt, not set an example by accepting the 21% haircut orchestrated by the banking lobby in July? (In order to still reach the 90% acceptance rate, the ECB was simply to be excluded from the calculation). Instead, the ECB promised Sodom and Gomorrah in case of a haircut (“Greek restructuring would be a disaster” – ECB’s Bini Smaghi, July 20th).

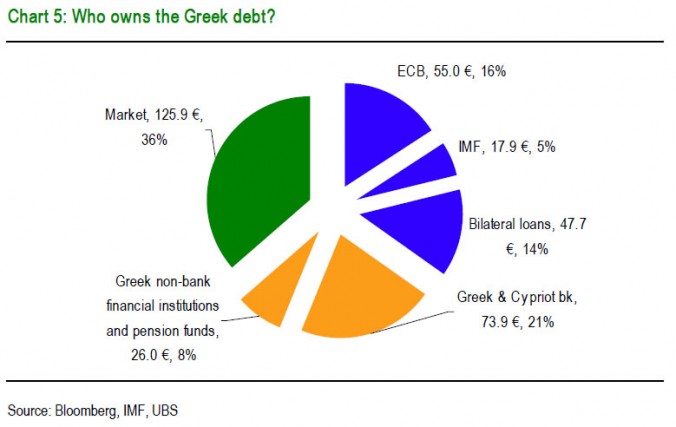

According to this chart, the ECB holds (nominal) EUR 55bn out of a total of roughly EUR 350bn of Greek debt:

Now they didn’t buy it at par (100%), but, let’s say, at 70% or EUR 38.5bn. A 50% haircut would reduce the value to 50%, at a cost of EUR 7.7bn. And this is only Greece (the ECB has other fine bonds on its books; EUR 165bn in total). Marked-to-market, losses would be much higher.

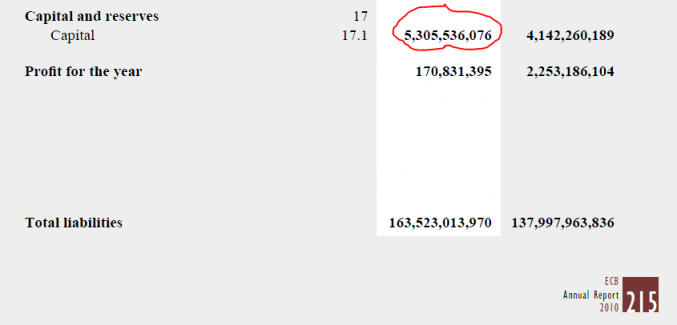

Problem is, the ECB has only EUR 5.3bn in equity. Here’s the balance sheet at the end of 2010:

Source: ECB 2010 annual report

(By the way, 5.3bn equity supporting 163bn in assets makes for 30x leverage).

By the end of 2010, the situation (due to unrealized losses on PIIGS bonds) was so dire the ECB had to ask national central banks (NCBs) to double its equity to 10.7bn effective 12/29/2010. However, not all NCBs could or would afford their share, and so the payment was stretched over three years (as seen in those “three easy low payments” commercials). Only 1.1bn was paid in a first installment, the remainder due at the end of 2011 and 2012 respectively.

To make matters worse, the non-Euro NCB’s (among them the Bank of England) are not liable for any losses the ECB incurs (since they are not entitled to share any profits, for example from seigniorage, either). That would explain why some NCB’s were not too keen on coughing up the big dough at once.

The ECB is basically bankrupt and would need to ask NCB’s (and those in turn their governments) again for more capital. This would create lots of cheer as governments are already struggling to protect their ratings from falling.

Governments could try to extract concessions from the ECB in return for recapitalizing, endangering the little independence and credibility that is left at this stage.

Hence the ostrich strategy: pretend the Greek bonds are worth what they were purchased for (and the ECB’s equity is still there). And this explains the ridiculous fight against allowing Greece a fresh start.

Maybe it’s time to pull a “Jordan” and claim that negative equity doesn’t really matter for a central bank (“Does the Swiss National Bank need equity” – Thomas Jordan, Vice Chairman of the Governing Board of the Swiss National Bank, speech in Basel 9/28/2011: http://www.snb.ch/en/mmr/speeches/id/ref_20110928_tjn/source/ref_20110928_tjn.en.pdf).

Somehow, accounting tricks are not explained in the ECB’s educational material for students:

One response to “Mystery solved: ECB can’t afford the Greek barber shop”

[…] Mystery Solved: ECB Can’t Afford The Greek Barber Shop Submitted by Alex Gloy of Lighthouse Capital Management […]