Tomorrow, Thursday (October 6th), the Swiss National Bank will report its foreign currency reserves for September at 9am local (3am EST).

We will know then how much Euros had to be gobbled up in order to defend the “peg”. Increasing tick volume in recent days looks suspicious – why would there be more volume than on days where the Swiss Franc reached parity? Or the day the SNB introduced the peg?

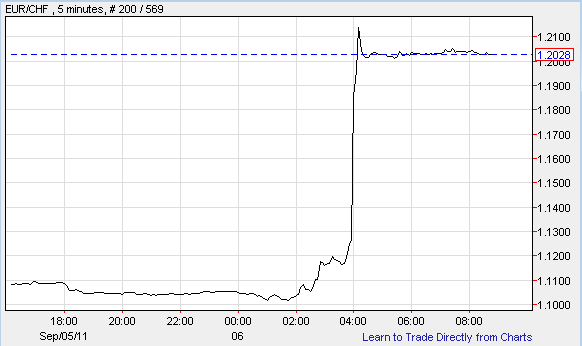

You can’t tell me that we recently had twice as much volume as on September 6, whenthis happened:

The SNB vowed to purchase “unlimited quantities” of Euros to defend the 1.20 barrier. How credible is that? Let’s look at some data:

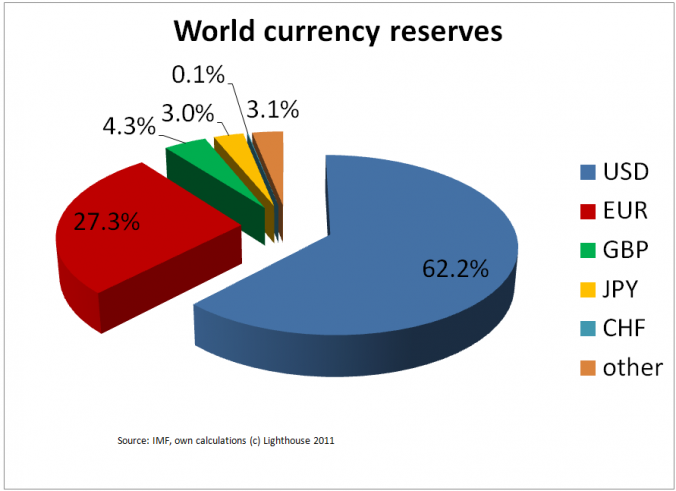

- The Swiss Franc amounts for 0.1% of world currency reserves. The Euro is 270 times larger:

Here is what is going to happen:

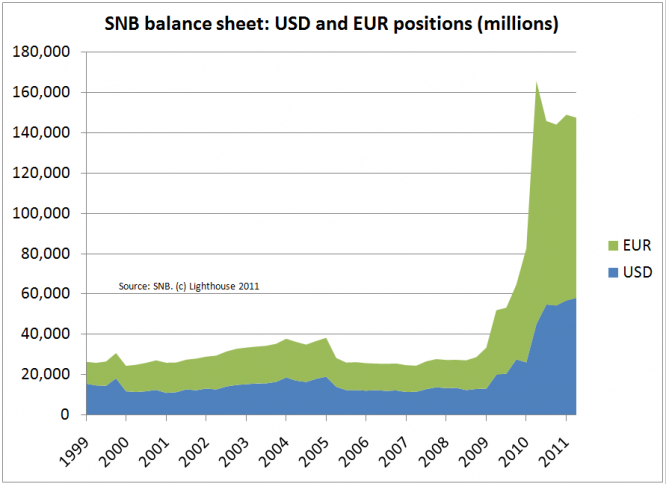

- SNB’s balance sheet will “explode” as they have to buy billions of Euros (a questionable asset, to say the least).

- For every Euro bought, 1.20 CHF are being released into circulation. CHF monetary base explodes, too.

- If the peg falls, the ensuing currency losses might bankrupt the SNB and costing the Swiss tax payer billions of CHF (they already lost 29bn over the last 18 months or 6% of GDP).

- According to rumors, the SNB is so sure about their ability to defend the peg they were selling Euro puts. Those would expire if the Euro did not fall below 1.20, allowing the SNB to keep the option premium. Is this an ill-fated attempt to “make back” some of the losses incurred earlier?

- In order to discourage speculators, the SNB tried floating rumors they might increase the peg to 1.25 or to 1.30.

- As the Euro weakens towards the Dollar, the Swiss Franc has to decline, too (in order not to strengthen towards the Euro). This makes the Swiss Franc cheap vis-a-vis the Dollar.

- A Greek default (or other Euro worries) might make the Euro even weaker, making it harder to keep it stable towards the Swiss Franc.

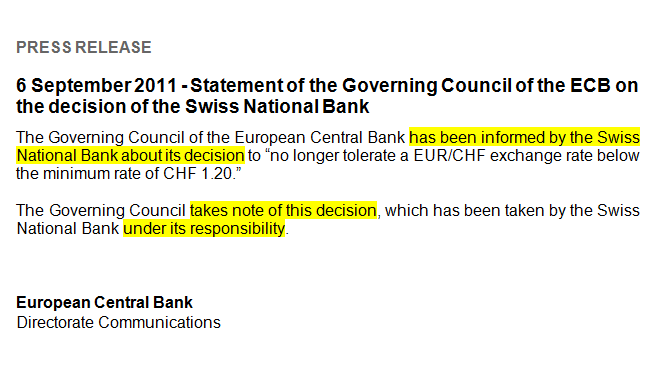

Please look at the statement by the ECB immediately following the SNB announcement:

- It is pretty franc (for a central bank statement anyway).

- Translated into plain English this means: “We have nothing to do with this decision, we will not support it and we wish the SNB good luck should the peg come under pressure”.

- This, from a “sister” central bank, is as little support as you can get.

- The ECB is probably not too happy another central bank is trying to keep the Euro strong.

Of course, there is one difference with the Pound Sterling being kicked out of the ERM (European Exchange Rate Mechanism) in 1992: the Bank of England (BoE), trying to defend its weak currency, had to purchase Pounds and sell other currencies (Deutschmarks etc) from its reserves. When they ran out of Deutschmark to sell, it was game over.

- In the case of the Swiss Franc, the currency is too strong, so the SNB sells its own currency, and purchasing another currency (EUR).

- In theory, this can continue ad infinitum. However, each time the SNB sells Swiss Francs, it increases the monetary base, also known as printing money.

- However, printing too much money will destroy the currency by making it worthless.

- How much did the SNB “print” so far? Looking at FX (foreign currency) reserves (the opposite entry in the SNB’s balance sheet) they increased from CHF 112bn (end 2010) to 253bn (end August 2011) or from 23% to 50% of GDP. This is BEFORE installing the peg (below chart as of end of Q2; SNB published only quarterly):

- It is possible the SNB didn’t have to purchase too many Euros yet, as the market saw no point in immediately attacking the peg. The move from 1.12 to 1.20 was very quick (minutes) and short-covering (from the perspective of a Euro short seller) probably drove most of it. Has the SNB has kept its powder dry?

- But as Greece defaults and possibly quits the Euro, a run on the Swiss Franc might return. And why not – thanks to the SNB you can get the Swiss Franc much cheaper now – a bargain.

- How many Euros will it take before the SNB has to give up? Do they have an internal limit? I don’t think so – they probably believe they can handle this. 100% of GDP? 200%?

- 200% monetary base to GDP would mean 1 trillion CHF or 750bn higher than end of August. At 1.20 that would be equal to EUR 625bn.

- Currency speculators work with huge leverage; 100 times is not unusual (anybody can open an account at one of the numerous online currency trading shops and speculate with 30x leverage). In order to sell EUR 625bn you would need “only” 6.25bn in equity. The hedge funds are probably circling the SNB like sharks already. Hence the regular leak of rumors of an increase of the peg in order to “burn” speculators.

- Options will also be part of the attack (if you load up on far-out-of-the-money options, and start moving the price in your direction, delta-hedging by market makers and counter-parties will almost “do the rest” for you).

- Currently, implied volatility for CHF options is still a bit high. Speculators might wait for it to come down further -paying less time value can increase the leverage significantly for out-of-the-money options.

It is unfortunate to see a people’s money being wasted recklessly and predictably. In the end, the only solution to avoid marking huge currency losses to market would be to join the Euro. Maybe that has been the plan all along – to ignore the people’s will and abolish the Swiss Franc through the back door. Voters could be confronted with the choice of either accepting the Euro or eating billions of losses as the SNB will have to be recapitalized.