Ben Bernanke promised to sit, like an elephant, on short-term interest rates for another two years – at least.

What were US Money Market Funds (MMF) going to do? US Treasury yields are 0.09% for 12 months, 0.02% for 6 and negative 0.01% for 3 months:

You can’t deliver negative yields to investors (that would empty the fund pretty quickly) and you still want to charge some management fees.

Enter funding-hungry European banks.

You might be surprised to learn the following: the world’s largest bank (by assets) is – French:

Source: Global Finance, 9/7/2011

Source: Global Finance, 9/7/2011

These huge collections of assets (compare to French GDP of ca. $2.1 trillion) have a bad habit: they want to be financed.

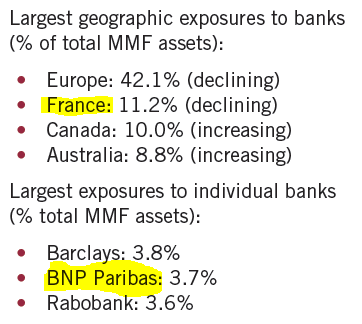

According to FitchRatings, French banks were the single largest recipient of funds from US MMF:

Source: FitchRatings, US Money Funds and European Banks, 9/23/2011

Source: FitchRatings, US Money Funds and European Banks, 9/23/2011

So far so good. A match made in heaven.

Then the European debt crisis intensified. Once Spanish and Italian bond yields started to peel off, a nagging thought crept onto the scene: Germany and France might have to carry the load of (yet unborn) EFSF (European Financial Stability Facility).

Credit default swaps on French government debt started to rise. This, in turn, would make French bank bailouts more difficult. French bank stocks tanked, and talk of possible nationalization added to further stress on the sovereign. A vicious cycle.

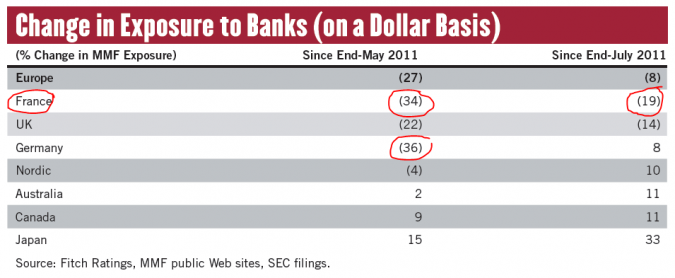

US MMF, of course, smelled the rat and began to withdraw their funding (by more than a third since the end of May):

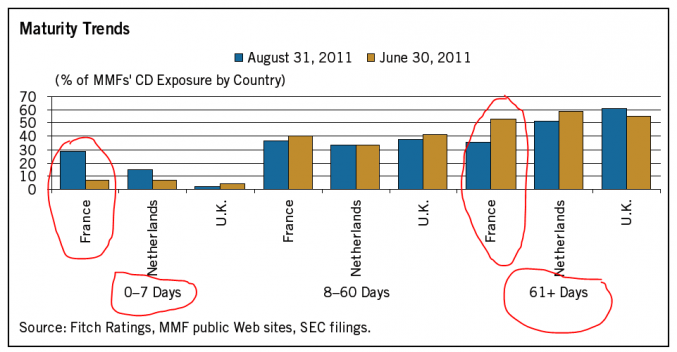

Adding to funding worries, loans left in place are getting more and more short-term (a week or shorter):

And this is where ZIRP (zero interest rate policy) goes full circle back to US institutions:

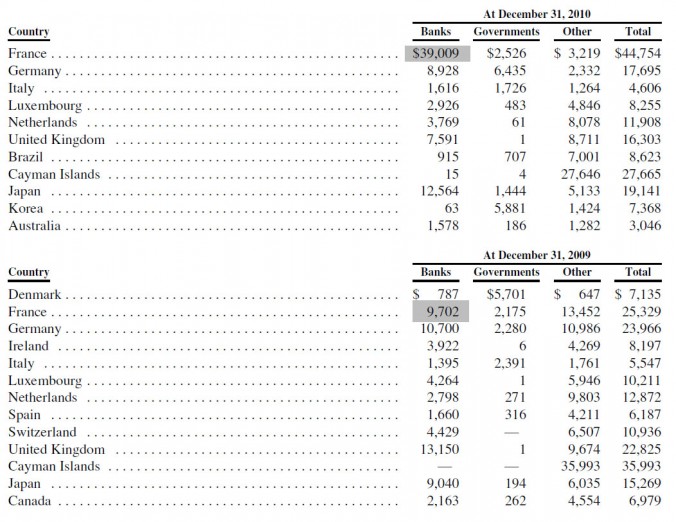

Source: Morgan Stanley 10-k

I am not sure what possessed MS to increase their exposure to French banks by 300% within a year (I suspect same dearth of lending opportunities given trillions of excess reserves parked at the Fed). The French engagement ($39bn) exceeds MS’s market capitalization ($26bn) by far.

Morgan Stanley’s share price has been cut in half since the beginning of the year and is now trading at less than 50% of book value. In other words: the market does not trust it’s books, or believes MS will destroy value going forward (or both).

I am not suggesting ZIRP is the only reason for problems; however, it is likely to have been an important trigger for a USD funding crisis at French banks.

One response to “The Fed, ZIRP and the French boomerang”

[…] The Fed, ZIRP and the French boomerang – Lighthouse IM […]