Something odd is happening. Germans are leaving the ECB. First Weber, then Stark. Why would senior German officials withdraw from the ECB just at a time when they should seek greater influence?

One explanation: to avoid having a conflict of interest once Germany re-instates the Bundesbank as the leading central bank of Europe.

Currently, Germany and Greece are engaged in a game of chicken; the Germans do not want the first “domino” of the Euro zone to fall, and the Greeks know that.

Each time Greece nears default, Germany agrees to a last-minute stick save without offering a far-reaching solution. Their aim is to limit the funds actually flowing to Greece.

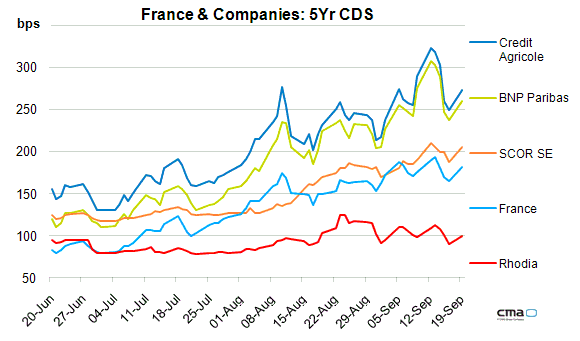

This, of course, guarantees the crisis to simmer on indefinitely, preventing a recovery in Southern Europe. But, as with every game, this one will have to end one day. Especially as German and Dutch 5-year CDS approach 100 bps. France’s CDS rocket has long left the launch pad, reaching 190 bps recently.

Source: CMA

Assuming the Euro zone will eventually disintegrate (as default without Euro exit does not make much sense) there are two scenarios:

1. Germany watches as one “PIIGS” after another is being forced out, leading to bank runs in those countries (as savers try to escape devaluation by transferring their deposits into countries remaining in the zone)

2. Germany (together with the Netherlands) decides to leave the Euro zone. Germans would be happy to get their Deutschmark back. Savers in PIIGS would probably not want to “speculate” in a new, unproven currency and keep deposits in their banks. The Euro would devalue, improving competitiveness for troubled countries. The Germans would have to live with the inconvenience of a strong currency. Something they are used to from the days of the ERM (European Exchange Rate Mechanism).

Scenario (2) would overall be less damaging for Europe.

This is when I remembered an article in DER SPIEGEL http://einestages.spiegel.de/static/topicalbumbackground/16161/der_geheime_bunkerschatz_der_bundesbank.html).

During the cold war, billions worth of a new series of Deutschmark were kept in a secret bunker under a harmless-looking villa near Frankfurt. This was in case the Russians tried to destabilize the West-German economy by flooding it with counterfeit Deutschmarks. The Bundesbank could have replaced most notes in circulation over a short period of time.

Video grab from DER SPIEGEL movie on secret stash of series “BBK II” Deutschmark, showing the 5 Deutschmark note

Video grab from DER SPIEGEL movie on secret stash of series “BBK II” Deutschmark, showing the 5 Deutschmark note

The “original” 5-Deutschmark note

The “original” 5-Deutschmark note

I would be surprised if Germany was not prepared for a scenario where the Euro disintegrates.

Finally, one odd detail: after meticulously hiding the secret stash for 25 years, Germany decided to send it to the shredder. In 1988. End of story.

Except: The Berlin Wall fell in 1989. Erich Honnecker was still in power in October of 1989. Who cannot remember the talk of Russian tanks possibly crushing those “Montags”-demonstrators. And the Bundesbank decided the risk of an escalation was so low they could dispose of the back-up currency for good?

DER SPIEGEL broke the story in 2010, 22 years after the back-up currency had allegedly been destroyed.

Either the gardener spilled the beans on his death bed, and the Germans needed to “prove” the back-up currency was gone (and not just moved behind “the door behind the door”) in order not to upset their Euro partners.

Or, someone “saw” new Deutschmarks being printed, and the Bundesbank had to come up with a good story on why that was the case.