With the publication of the half-yearly “World Economic Outlook” by the IMF it’s time again to look confidently into the bright economic future – or is it?

Let’s examine how the IMF wizards fared compared to their own (past) forecasts:

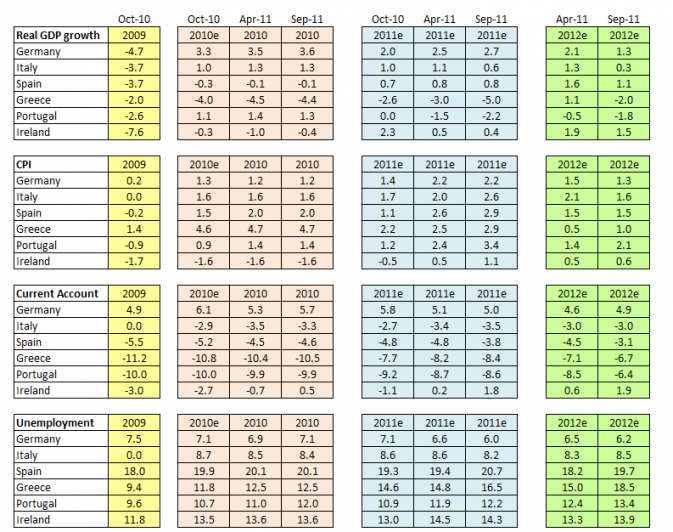

Source: IMF World Economic Outlook, Table 2.2 (Selected European Economies);

Source: IMF World Economic Outlook, Table 2.2 (Selected European Economies);

October 2010 (page 75), April 2011 (page 67), September 2011 (page 78)

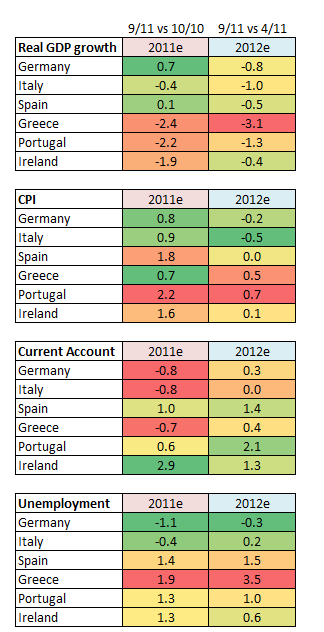

And here is how the forecasts have changed (in percentage points):

(Source: WEO, own calculations)

(The current forecast for 2011 has been contrasted with the one published a year ago. The current forecast for 2012 is compared to the one done in April of 2011.)

Observations:

- “The-winner-takes-it-all” Germany will have better growth and less unemployment than expected for 2011.

- Despite having underestimated German inflation for 2011, the IMF reduced its forecast for 2012.

- For Italy, Ireland and Greece it’s all downhill in terms of growth (2011 and 2012), CPI (upwards revisions for both years) and unemployment (how are those bail-outs working for you, Greece?).

- Everybody except Germany now will have less than 1% of real GDP growth in 2011. This comes with the added benefit of accelerating inflation.

- Everybody will continue to finance Germany’s positive trade balance – and this is why default without Euro exit will not change much for the PIIGS.

- The German-Greek “game of chicken” (1) will continue and therefore guarantee the Euro zone being constantly on the edge of the cliff.

1) German-Greek game of chicken:

Germany: “You can’t spend that much. From now on, you can’t spend more than you rake in.”

Greece: “Okay, boss”

Greece: “Okay, boss”

Later: Greece: “Boss, we’re out of money!

Germany: “WTF? Okay, here’s another Euro. But you have to adhere to these strict austerity measures. No exceptions!”

Greece: “Okay, no problem.”

Later: Greece: “Hey, looks like we will have to default…”

Germany: “Nobody is allowed to say the d-word. It’s not in the contract. Maastricht or whatever. You can’t. Okay, here’s another Euro. Last time. Really.”

Greece: “Okay, thanks.”

Later…