Central banks own most of the world’s gold (30,562 tonnes compared to 2,158 tonnes in ETF owned by private investors). Why? Our entire monetary system is based on fiat currencies (the paper is not worth anything – the value stems from the trust someone else will accept this paper for the value printed on it). So there would be no reason for central banks to hoard these huge amounts of gold.

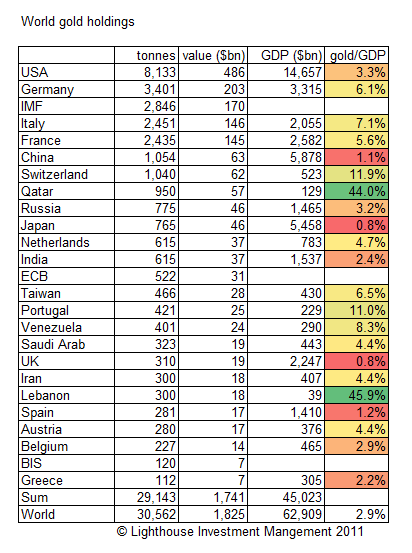

Let’s look at gold holdings in relation to GDP:

Sources: World gold holdings: Wikipedia; World GDP 2010: IMF via Wikipedia

There is a simple equation explaining the relationship between monetary base and goods produced / consumed in an economy:

M * V = p * q,

where M = amount of money in circulation, V = velocity of money, p = price level and q = real value of final expenditures (GDP).

Assuming V (velocity) and p (inflation) being given, the size of an economy will be determined by the amount of money in circulation (M).

Now listen carefully.

Assume you wrecked your currency via excessive printing (“quantitative easing”). The only way your people will trust a newly issued currency is by backing it with gold. Example: German Rentenmark (introduced November 1923 at a ratio of 1,000,000,000,000:1).

Hence the amount of gold available at the central bank determines the amount of money it can issue.

The (non-inflationary) monetary base determines the size of the economy.

The size of the economy determines the standard of living.

That’s why China, with only 1.1% of gold in relation to its GDP, urgently needs to purchase more gold. According to some sources, their gold stock is already up to 3,000 tonnes.

Investors are well advised to take this into consideration.