Fed Chairman Ben Bernanke is a magician. He can make trillions of debt disappear. Impossible? Let me show you how:

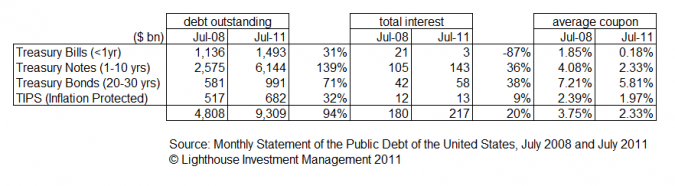

Please take a look at the following table[1]. We are only going to look at the total marketable public debt[2]. Broken down into categories by instrument I compared the latest data (July 2011) with the numbers three years ago (July 2008). You will see that while Bills outstanding increased by 31%, the total interest to be paid declined by 87%. The explanation lies in the Fed’s ZIRP[3] – she’s sitting on interest rates like an elephant on a ripe tomato. The average yield on Bills outstanding declined from 1.85% to 0.18%.

The biggest category (Treasury Notes) saw an increase of 139% in the amount outstanding; yet interest payments increased only 36% as the average coupon dropped:

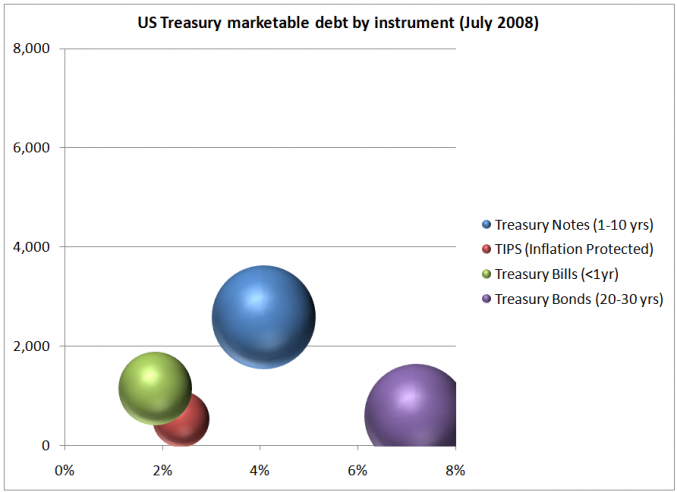

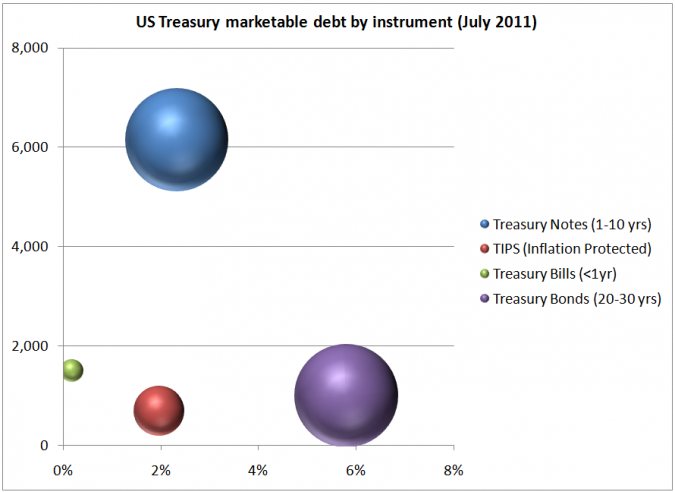

Now imagine the interest rate on Treasury Bills dropped to zero (this is not far-fetched as current rates show)[4]. Interest payments on almost $1.5trn would disappear. Under the assumption that refinancing is not a problem, it is almost as if the debt itself disappears. To illustrate the point please compare the following two bubble charts (2008 and 2011). The size is the amount of interest due. Average interest rate on the x-axis, amount outstanding (in $bn) on the y-axis:

Watch what happens to the green bubble (Treasury Bills) despite an increase in amount outstanding:

It’s almost gone! Magic!

The issuer constantly rolls over maturing debt, paying no interest. This is money-printing (and deficit spending) nirvana.

The next target is obviously the big fat blue bubble (Treasury Notes). Guess why “Quantitative Easing” (purchases of Treasuries) was concentrated in that maturity spectrum. Why not target the “long end” (20-30 year maturities) to bring down 30-year mortgage rates some more[5]? It would take too long for lower coupons of newly issued bonds to bring the average coupon of this category down substantially.

All needed to keep this perpetuum mobile going is demand from investors looking for (relatively) safe assets. A crisis in the Euro-zone couldn’t be more helpful in achieving this.

Oh, you wanted to know how debt can disappear twice (once the roll-over plan fails)? Print, baby, print. Inflation cures all debt ills.

Alexander Gloy is founder and CIO of Lighthouse Investment Management

[1] Available at www.treasurydirect.gov

[2] Public marketable debt (9.4trn) plus public non-marketable debt (5trn) yields total public debt (14.4trn). For the purpose of this exercise I only looked at the public marketable debt.

[3] ZIRP = Zero Interest Rate Policy

[4] Government paper currently yields 0.01% for 1 month, 0.02% for 3m, 0.07% for 6m and 0.11% for 1 year.

[5] Presumably to help the housing market by lowering mortgage rates (but cheap financing is already available for borrowers with decent credit scores).